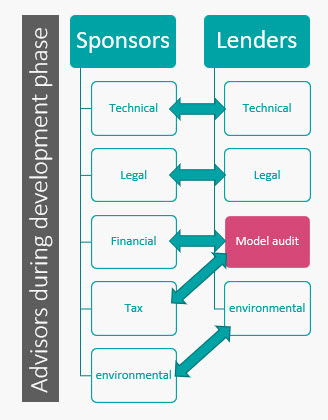

Because of the nature of a project finance transaction and its riskiness, the due diligence process of such deals is much more complicated and costly than that of a corporate finance structure. Many external advisors will be employed to assess the project’s technical and financial viability and its risks.

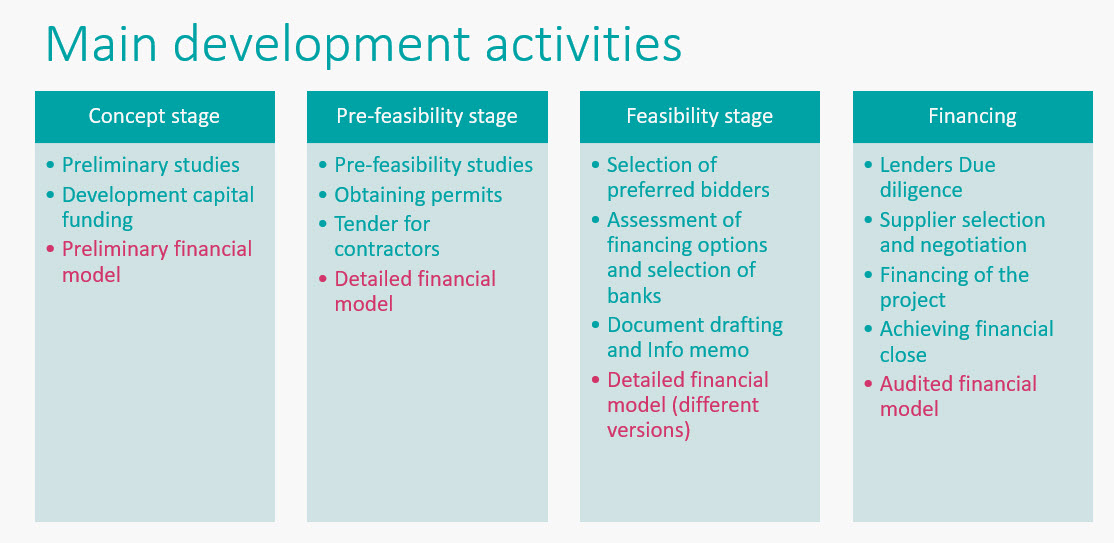

When it comes to advisors, sponsors will hire their own experts at early development stage even before the lenders are engaged. One of the main expertise required is financial advisory. Some sponsors have financial expertise in house and do the financial advisory works themselves but if not, they will hire an external financial advisor to take care of the financing issues, debt and equity raising and build a financial model. The creation and maintenance of a financial model is an important task that needs to handled during the development phase of a project and by experts in project finance modeling. It’s a tool that will be shared with different stakeholders and used for negotiating different contracts.

When lenders get engaged in the deal, they will hire their own advisors and among these advisors, they also require a financial model auditor to check the work done by sponsors on the financial model. The cost of the model audit is payable by sponsors and can be considered as part of the external development costs and be included in the construction budget.

However the question that I want to raise here is whether or not the auditor’s report and approval is a requirement from lenders, why and when do we need to hire a financial model auditor?

This topic follows my other posts about the importance of a financial model in a project finance transaction and my dedication to make it understand to parties not to consider the financial model as just another document in a checklist.

Before I get into the heart of the topic, let’s review what are the main tasks of a financial model auditor.

A financial model auditor is an independent third party firm that is hired to review the financial model mechanics, and make sure that the model can be used for the evaluation of the project and conduct sensitivities on the key projects inputs and outputs and also to check that the inputs that goes into the model and the calculation of cash flow items are in line with project documents and contracts.

Download the Sample RfP for model Audit Services

As you can consider from the above paragraph, the model auditor has a crucial role and a big responsibility. The seal from the auditor means that ceteris paribus (everything else remaining the same), the base case financial model represents the current state of the project and is in line with project agreements. Parties will then have more comfort that what they are presenting to their boards is not based on a model with mechanical errors or with inputs that are not in accordance with the project.

My issue is about the timing of the model audit.

In most transactions, by the time the model auditor is engaged in the project, the model has been used by many stakeholders, in some cases the model or a version of it has been used to set the tariff for the project or used for negotiation with lenders, O&M, EPC and other contractors. Then 6 months down into financial close date, and because it’s condition precedent to financial close, the financial model auditors will be hired and there will different rounds of review until the model auditors gives the green light on the model so basically the auditor’s approval is considered as just another check in the checklist and not treated as what is meant to be which is to give comfort to parties that the model is well structured and is containing the relevant inputs.

In my opinion, the issue of the timing of hiring the model auditor has the following issues:

- by the time the model gets to the hands of the model auditors, many important decisions are made using the not audited financial model like the setting the tariff, negotiating with contractors and lenders.

- In the last stages of a project development, the clock starts ticking for financial close date. At this stage, there might be no time for rebuilding the financial model from scratch. In my experience working with over hundreds of deals, not even once I have come across a case where a model auditor suggested to rebuild the model from scratch. In most cases there was no need for it but there were cases where it was better to rebuild the model from scratch rather than fix the financial model. Once concrete example was with a model that contained block of copy and paste with long running time. The model was in the process of being audited by the lender’s auditor but then just before the last round of audit, there was a need for a Monte Carlo simulation required by one of the insurance providers. It was impossible to run the Monte Carlo simulation on that model so at that time, lenders decided to make their own version of the model so we had to maintain two models in parallel throughout the due diligence process.

- the way most model audit contracts are drafted is to accommodate for a limited number of iterations with additional costs for more iterations. The first iteration is the one that should tackle most structural changes required to be applied to the model and the remaining iterations is to check that changes requested are taken into consideration. If, however in the interim, things changes that requires a structural change to the model. Then, typically sponsors are reluctant to make additional structural changes because it might be costly both in terms additional cost of audit and delay in financial close date. To give you an example, I reviewed a project model and the model was unnecessary complicated. There were many options included that were no longer needed. I suggested to simply the model but I was told that since the model has already been audited, they didn’t want to make changes to the model and the only change that they were ready to make was changing inputs. Again, this situation created a need for a parallel model.

I am interested to know your view on this topic:

- How do you handle your project finance modeling in your deals?

- Do you consider the model as another document in the lenders checklist or do you really use it for assessing your project?

- Do you have any inhouse expertise to handle the financing models tasks or do you rely on external consultants?

If we are not connected on LinkedIn and you like my content please consider connecting with me and let me know what are the other topics that you like me to post.