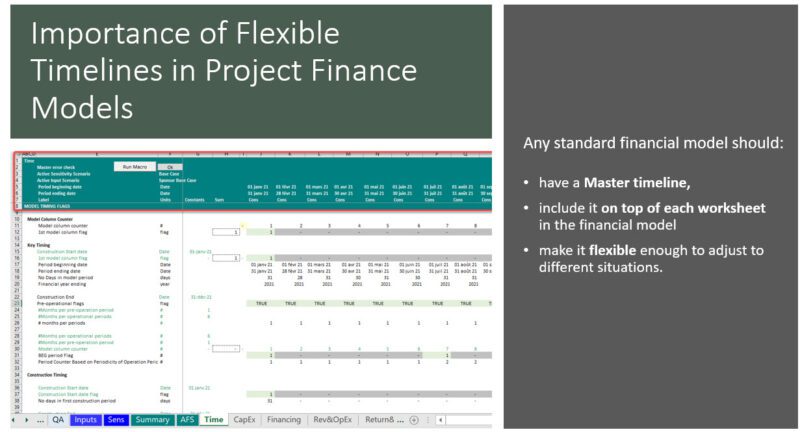

Any good financial model should have a flexible dates and standard time line built in across each page in the model.

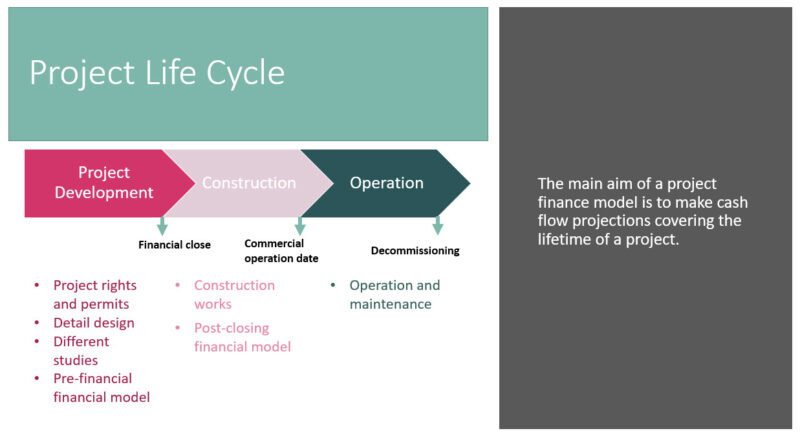

Project finance is like a living human being and has different stages of life.

Development Phase: concept stage and appraisal stage where you get the permit, do studies, negotiate contacts and will eventually lead to financial close.

Construction phase: This is the stage post financial close when the construction program is running hopefully smoothly and ends with Commercial operation date.

Operation: from commercial operation date until end of projections (end of life of the project)

The main aim of a project finance model is to make cash flow projections covering the lifetime of a project.

So Any standard financial model should:

have a Master timeline,

included on top of each worksheet in the financial model

it should be flexible enough to adjust to different situations.

The decision on the model on the model periodicity meaning the number of months in each model period is a decision that you need to make during the design stage of the financial model.

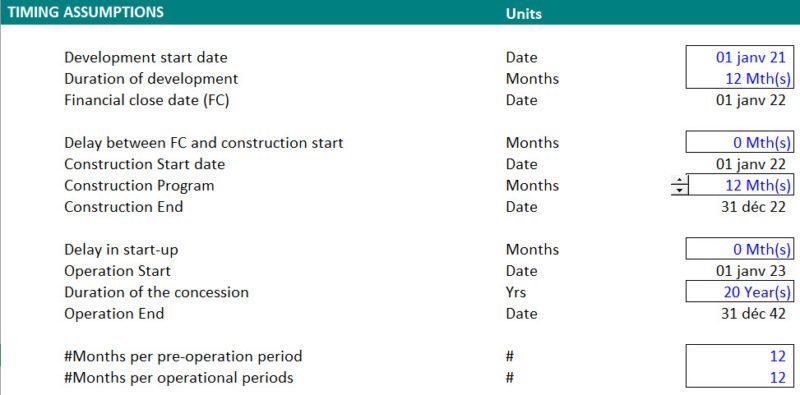

You mainly need the following inputs in order to build necessary flags and counters to build in flexibility in the model:

If You want development phase flows in the model then you can start with the development start date and the duration of the development works as we said development phase ends with financial close. Then if there are no delays between financial close and start of constructions works, you can assume that construction start date happens at financial close. Then you need to define the construction program meaning how long it takes to build the project and bring it to operation. If there are no start up delays you can assume that operation starts with construction end. Then you need to have the numbers of years of projections to come up with the model end date.

Once you have the inputs set up in your model, the next steps is to build couple of timing flags and counter and then used them in across your calculation blocks.

I have a suggested template for building flexible timelines in your financial models. I recommend that you have a look at it and use it as an inspiration to build in your own master sheet and master timeline.

You can download it from my Eloquens channels and link below:

Download Timing Flags and Master sheet in a Project Finance Model

Be sure to also watch our accompanying video tutorial: