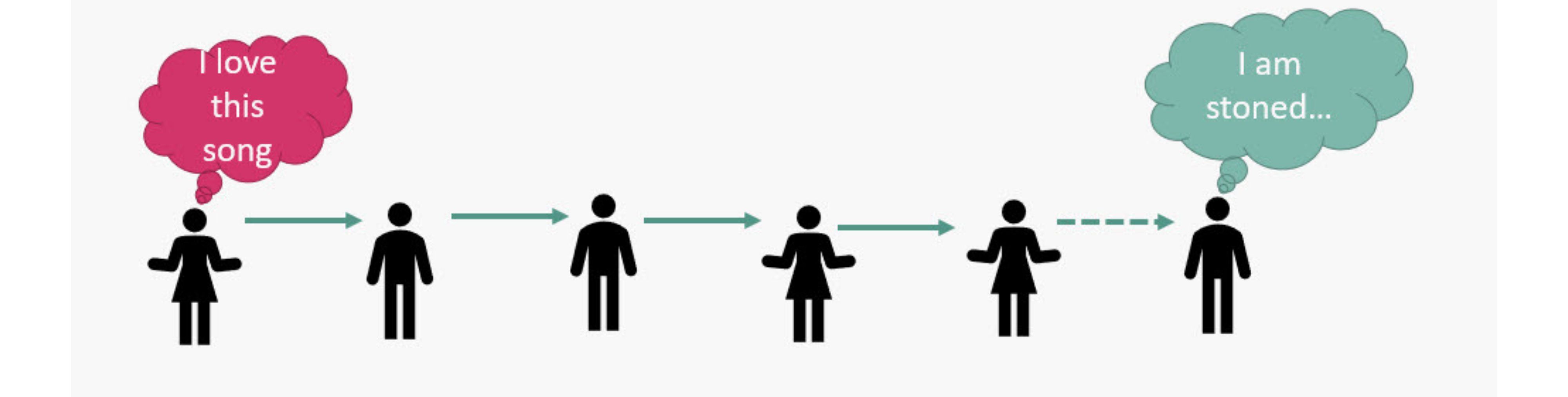

You might have heard of or played the broken telephone game. It is a game played by 3 or more people where a phrase is whispered in someone’s ear and it gets passed around the circle. When the last person in the circle says what they heard, it’s usually very different from the original word.

In this post, I want to open the discussion with you about why if in an organization or business such a set up exists then the end results will not be funny at all but potentially quite dangerous. More specifically I want to talk about the role of a financial modeler in an organization and how inefficient it can become if the information goes from the managers to the financial modeler through a series of other intermediaries. Here’s how I see it:

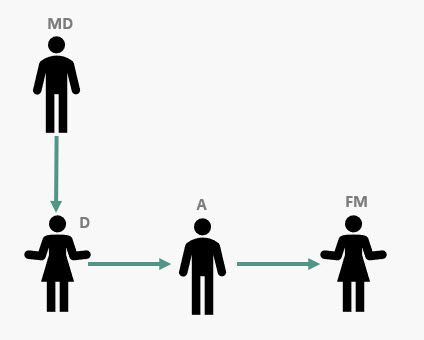

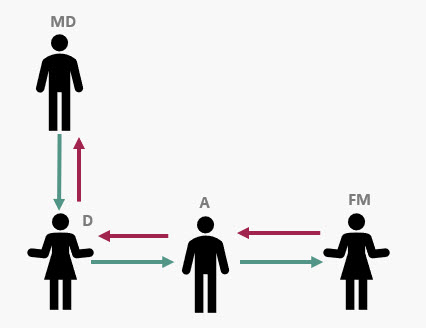

Managing Director (MD) together with the Director (D) will have to make decisions on different levels. For the commercial matters, they will need to test the impact of their decisions using a financial model. So they will discuss among themselves and formulate the questions that needs to be answered. Then the Director will reiterate the issue to his or her Assistant (A) (or”Associate” or”Analyst”). The assistant will then transmits the message to the Financial Modeler (FM).

Managing Director (MD) together with the Director (D) will have to make decisions on different levels. For the commercial matters, they will need to test the impact of their decisions using a financial model. So they will discuss among themselves and formulate the questions that needs to be answered. Then the Director will reiterate the issue to his or her Assistant (A) (or”Associate” or”Analyst”). The assistant will then transmits the message to the Financial Modeler (FM).

When the information reaches the financial modeler , he or she might have more questions. Then the questions should circle back from the assistant to the director and maybe the director will need another round with the managing director to get the additional information causing further delays in the completion of the task.

This situation is even worse if the environment is toxic, meaning that there’s a battle for power. Then if this is combined with the telephone game, then the situation will become dangerous for the business as a whole.

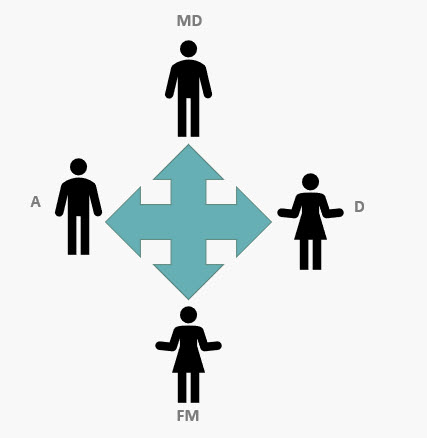

All these could have been avoided if in the first meeting in between the director and the managing director, both the financial modeler and the analyst were present, could have asked their questions and have the full context before doing the task.

Getting people involved in the process will:

Getting people involved in the process will:

- Avoid the need for the information to pass through between different levels before it reaches the final recipient.

- will give a sense of belonging to all members of the team and

- will also results in a much better analysis of the situation. By having the full picture and knowing the reason for doing things, the financial modeler can not only solve the problem but to provide multiple options for that same problem. This is what I call a solution provider mentality rather than just a problem solver.

If you are facing with such an issue within your team, then I would recommend to go and talk to the highest executive person within your organization and explain exactly what I told you here. Don’t make it about you and complain that your voice is not heard or cry that you are not involved. It’s about the business and the flow of information. You can explain to them that getting you as a financial modeler directly involved in discussions can result in faster processes, better analysis and eventually better decision making.