I am always interested to know how companies and institutions handle their financial modeling tasks and I always ask the questions to the people I meet. So far, here are the answers that I have received:

- “We hire short term consultants on project by project basis”

- “We have long term consultants that accompany us in all of our projects.”

- “We have financial modeling capabilities inhouse.”

- “We work with a financial modeling company specialized in building financial models.”

If you look at the above cases, the difference is mainly on the extent the person or entity building the model is involved in the deal.

In some of the above cases, there might be a complete disconnect between the financial modeler and the deal.

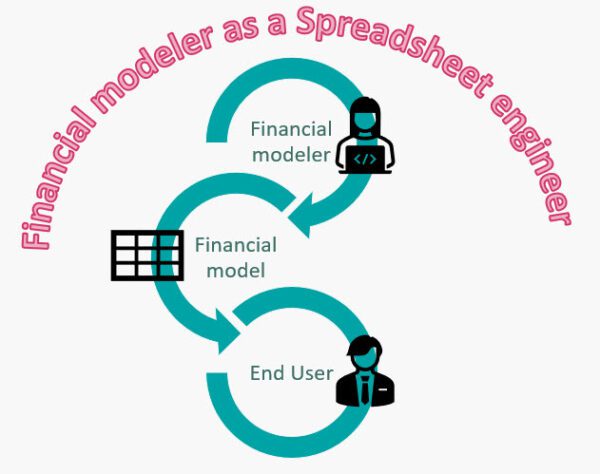

Meaning that the financial modeler is treated as what I call a “financial model mechanic” meaning that it’s disconnected from the transaction and discussions. Whether it is an individual or a company, the role of the financial modeler is just to hand in a typical or template financial model. Then the client will have to adopt the model, use it and maintain it throughout the project’s life cycle. If there’s no one within the team that can maintain the model, then at some point in time the model will become obsolete and they either have to go back to the financial modeler to make changes or they will need to hire another consultant to do another model.

I have seen this in one of my recent transactions that a company has hired a very good financial modelling company to build a model for them and they paid a very high free up-front for the model. Because the fee was very high then to justify the fee, the model was extremely complicated and contained many options that were not necessary for the transaction in question. When I asked them to send me a revised financial model with revised assumptions, they said it’s a financial model they paid quite expensive and internally they have difficulties to use.

On the other hand, there are companies that have people responsible for doing the financial model for their transactions but they don’t use their full potential and just treat them as the financial model mechanic meaning that they take the model for negotiation and in case they need changes, they call the modeler to the mechanical changes required.

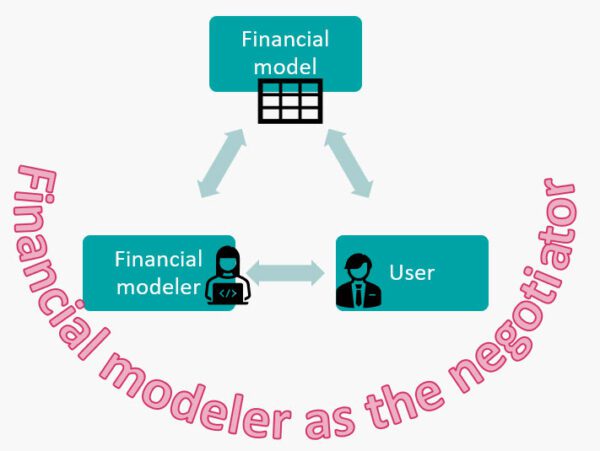

In my experience what works best is to have someone within your team with financial modeling skills but then engage the person in all aspects of the transaction. Remember the financial model contains all important information concerning the deal so almost all aspects needs to be double checked with the financial model. Also, if you engage your financial modeler in the discussions, then your financial model will always be up to date with the latest information concerning the project.

For more on this also check out my other post on “The financial model is more than just another document in a checklist.