Debt Financing versus Equity Financing

In my previous life as a trainer in executive programs in Investment Appraisal, in one of the training program we had a participant from a rich oil producing country who was skipping some of the sessions. Once during a coffee break, I asked him why he is not attending regularly and whether he’s bored or has other work engagements? He told me:” Listen Hedieh, in my country, we have money. We don’t select projects, we do all of them!”. Of course he was joking but there’s a kind of truth behind it.

In the appraisal stage, when you think about how to finance a project, you need to consider two things:

- What are the available financing instruments?

- How much will each instrument cost?

Once you have an answer to these questions, you then need to plug in the information into a financial model and understand which structure best suits you and the project.

Let’s take the example of a project developer who is looking at a 10 MW solar PV project. He/she has got all the required authorizations and now is looking to raise capital to build the plant and it’s associated infrastructures.

There are mainly two type of financing instruments: Equity, and debt financing. in a typical project finance deal, the choice will be of a mixture of the two. The gearing or debt-to-equity-ratio shows how much of the total funding required for the project completion is funded by debt. For example, 70% gearing means that 70% of total project cost can be raised as debt and the remaining 30% needs to come from shareholders in form of equity or some sort of subordinated debt.

When you are doing the appraisal, you also might want to consider the option of funding your construction with equity only and then refinance it after construction completion. Off-course that depends on the answer to question #1: How much equity is available?

Back to the story of the participant from the rich oil producing country, in most cases, he can consider the option of 100% equity funding because he has the resources, but it doesn’t mean that it’s the best available option. That’s when the appraisal and financial modeling comes into the picture.

If you have the funds to fund the project with equity only then next step will be to consider it as an option before raising debt. You might say, debt is cheaper than equity and there will be undeniable gains of having debt in your financing package. But there’s two things that might make full equity financing during construction more attractive or just worth considering:

- Time: Lenders due diligence process can be quite lengthy and complex and can lead to long delays in construction and commissioning. these delays can have financial impact due to higher transaction costs and delayed revenues. For a solar project that takes maximum 6 to 12 months to complete, you have to consider at least 6 months for lenders to complete their due diligence and close. So one thing that might be important to quantify is the cost of 6 months delay in project construction start date due to lender’s process.

- The cost of capital: The project risk changes over different phases. The highest level of risk is mainly during the construction phase of a project when the cash flow are negative and there are risks of delays and cost overruns. That is why during construction phase both equity and debt are more expensive. Once construction is over and project start generating cash, project risks goes down substantially and the cost of capital of may be lowered by refinancing the project after the construction phase.

Now let’s look at the example of 10 MW solar project and the financial model.

Example of Scenario analysis on financing structures

Financial model structure and set-up:

- First of all you can facilitate running different financing structures by presenting your contant inputs in form of scenarios and to include a scenario reported to populate the scenario results. For more on that please refer to my One Model Approach discussion.

- Debt Financing instruments: You need to at least model two tranches of debt, one for construction and one for refinancing.

- Equity Financing instruments: Include option for pure equity and shareholder loan

Scenarios:

Scenario 1: Construction funding with debt and equity ratio

- In this structure, 70% of the debt is raised to fund construction uses of funds and project need to repay the debt post construction (6 months).

- Assuming that lenders need 6 months to complete their due diligence and reach financial close and there will be additional development cost incurred due to the delay in closing (assuming +50kEUR).

- the main terms for the construction debt are:

– all-in interest rate of 5% p.a.

– Maturity of 15 years

Scenario 2: Construction funding with debt and equity ratio and refinancing post construction

- Same assumption as scenario 1 is assumed for construction phase

- 12 months post COD, assuming 70% of debt is refinanced refinanced using cheaper debt capital (with flexibility to change the refinancing date.)

- The main terms of the re-financing loan assumed are as follows:

– All-in interest rate of 4% p.a.

– Maturity of 15 years

-3% pre-payment penalty on the outstanding construction debt

Scenario 3: Construction funding with full equity and refinancing post construction

- 100% of equity to fund construction.

- Construction starts 6months earlier than scenario 1 and 2.

- Construction cost saving for financing fees, lender’s due diligence fees and additional development fees due to delay in closing.

- 12 months post COD, assuming 70% refinancing with flexibility to change the refinancing date.

- The main terms of the re-financing loan assumed are as follows:

– All-in interest rate of 4% p.a.

– Maturity of 15 years

-3% pre-payment penalty on the outstanding construction debt

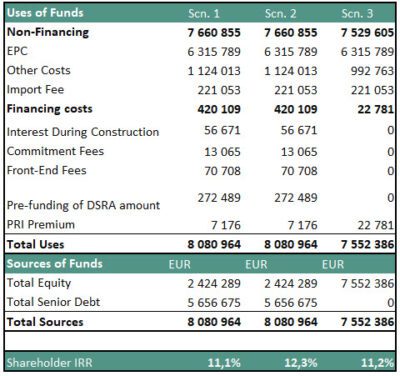

Here below is a summary comparison of the 3 options for this specific PV Project:

As you can see in this case, the best case from the point of view of the sponsors is scenario 2 with 12% equity IRR and that is obvious because post construction, the expensive equity and debt are refinanced using cheaper debt and it is assumed that the potential gains from refinancing goes to equity (this might not be the case as it can be shared with other parties like concessioner/off-taker)

In this specific case, we are in break-even in scenario 1 and 3 and the choice will have to be based on risks and therefore you need to do additional sensitivities to give more information to management to make a decision.

The idea of this example is not to come to a conclusion. The choice for the type of financing is project specific. However, I hope from this example, you understand the importance of having a flexible financial model that can assist project developers in decision making and for making the optimal choice when it comes to capital structuring.

Make sure you check out the below where I walk you through a project financial model for a solar project and show you how you can do an analysis of the optimal capital structure meaning the best mix of debt and equity financing that minimes the project cost of capital and maximizes the equity return.

You can also download the financial model used for this analysis from below link. To thank you for reading my blog post, you can get 40% discount by use the promocode:”FINEXMOD”.