Previously I started a series of posts that I named Project finance storytelling. I made couple of episodes but a graphic designer friend told me that people have no time for my stories and they just want to get the point! I listened to her and stopped making any more storytelling content. Then the other day I was talking to a professional financial modeler by the name of Tokollo and he told me that he liked the storytelling content of mine! I was very happy to know that he liked it because I truly believe in this way of transferring and sharing knowledge. So I hope you like it and thanks Tokollo for the encouragement.

This episode is about the one who is working on a power project and has to measure the impact of shortening the duration of the Power Purchase Agreement on the financial viability of the project. Let’s go…

The one with a shorter purchase agreement

Kofi is the financial director of a power project and has been working on this project for almost a year now. He had a series of negotiation with the authorities and had come up with a draft Power Purchase Agreement (PPA) indicating 20 years for the duration of the PPA.

This morning while having his morning coffee, he received a call from the financial advisor to the government telling him that the government is considering to shorten the duration of the PPA and that he will be receiving an official letter in the coming days.

He hanged up the phone and sat down in front of his computer and started thinking about what will be the consequences of this decision. he made 3 columns, one for technical, one for legal and another for commercial impacts. We will skip the first two and focus on the commercial aspects of this decision.

First of all, he opens the financial model and changes the duration of the PPA in the timing assumption from 20 years to 15 years. Although he knows that the financial model is build based on best practices and it is flexible but whenever he changes the timing assumptions in the model, he feel a kind of get butterflies in his stomach thinking of a slight probability of the model not handling the change so he changes the input and he is relieved to see that all is working properly. He checks in the financial statements and all operating cash flows are adjusted to the change in timeline.

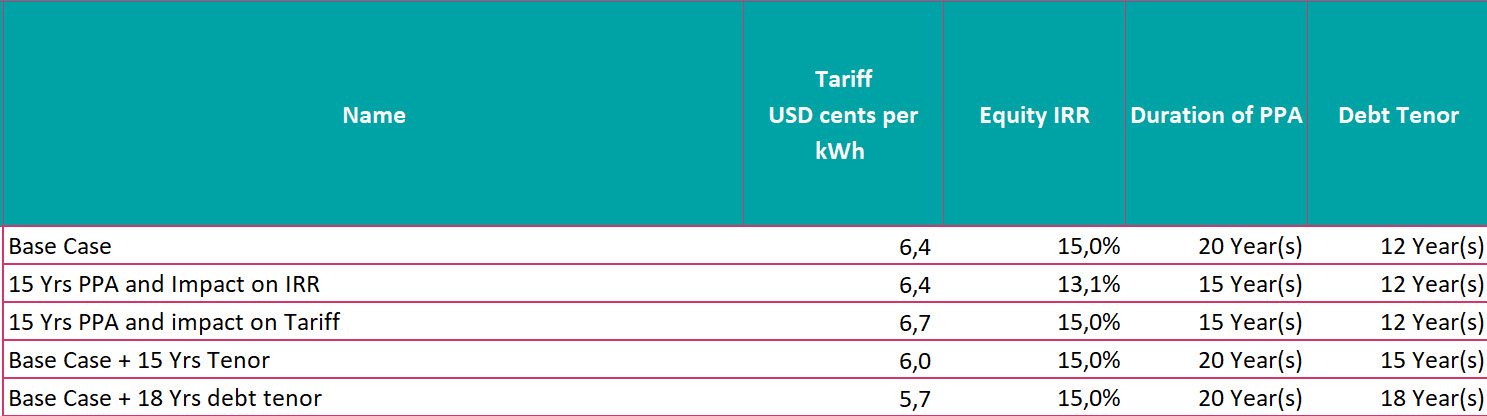

So now that this done, he checks the equity IRR and sees that there’s 2% decrease in the IRR.

He thinks to himself, if I want to negotiate this shortening of the PPA with the government and I tell them that the impact of reducing the PPA by 5 years has %s impact on the equity IRR, it is not a very strong argument to convince them against this decision.

So he starts meditating on other commercial impacts of this decision on the project.

He thinks about his recent discussion with lenders. The lenders are currently proposing to fund 70% with 12 years maturity. He asked the lenders to consider increasing the maturity to 15 years mentioning the impact that it will have on the tariff. Since it is a development bank, they are mandated to invest projects that has the most positive development impact. However if he presents a 15 years PPA to the bank then increasing the maturity will be out of the discussion as banks require a cushion in the form of a loan tail between the debt tenor and the duration of the PPA.

To put it in a numeral terms, he runs the model with 15 years tenor and 20 years PPA and the resulting tariff is 6.0 cents$/KWh.

While a 12 years loan with 15 years tenor gives a tariff of 6.4 cents$/KWh.

This is a great argument against shortening the PPA because it involves not one party but it has an impact on the project and also on the whole economy.

However in the memo that he is preparing addressed to the authorities, he will be mentioning the impact on shareholders return. There’s the IRR impact and also one reality is that some of the shareholders will not stay in the project for long. They will consider exiting and selling their shares 2 to 3 years post commercial operation date. When they sell the project let’s say in year 3 to another investor, it makes a significant difference if they sell 11 years of future cash flow rather than 16 years in case of 20 years PPA.

Other things that comes to his mind is the delays in concluding the contract negotiations. Opening this topic will require additional discussions and hiring of legal consultants to redraft the contracts and this will both have a cost in terms of fees to the advisors and also the cost of delay in closing the project and starting the construction.

He is now satisfied with his arguments, leaves his desk with a clear mind and will work on putting together a letter to the authorities listing all the arguments above hoping that he can convince them against this decision.

Moral of the story:

- Have a flexible financial model

- when negotiating something always remember to talk in terms of other’s person interests more than your own interest

- Have a win win mindset when negotiating: A win win situation is the result of a mutual-gains approach to negotiation in which parties work together to meet interests and maximize value creation. (Source: https://www.pon.harvard.edu)