Imagine a mining company adopting a profit-sharing with mining workers based on an IRR hurdle.

You are probably familiar with economic or profit sharing based on IRR thresholds. You probably have come across it in the context of two or more shareholders or different shares (A type versus B), free carries, and so on…

To make it utopique, we want to imagine a world where Government and international agencies require mining companies to adopt a profit-sharing mechanism with their workers.

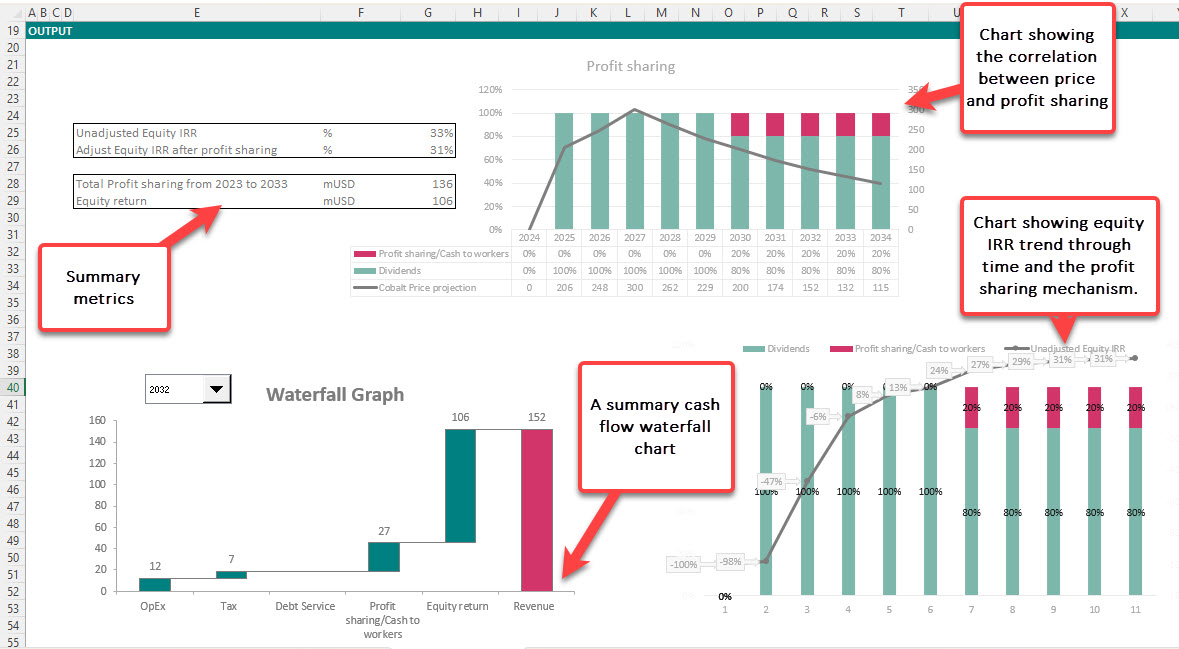

Financial modeling of the the Equity IRR profit-sharing mechanism

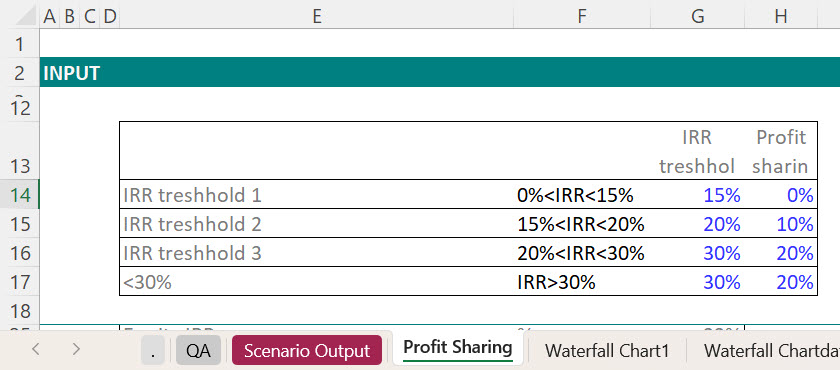

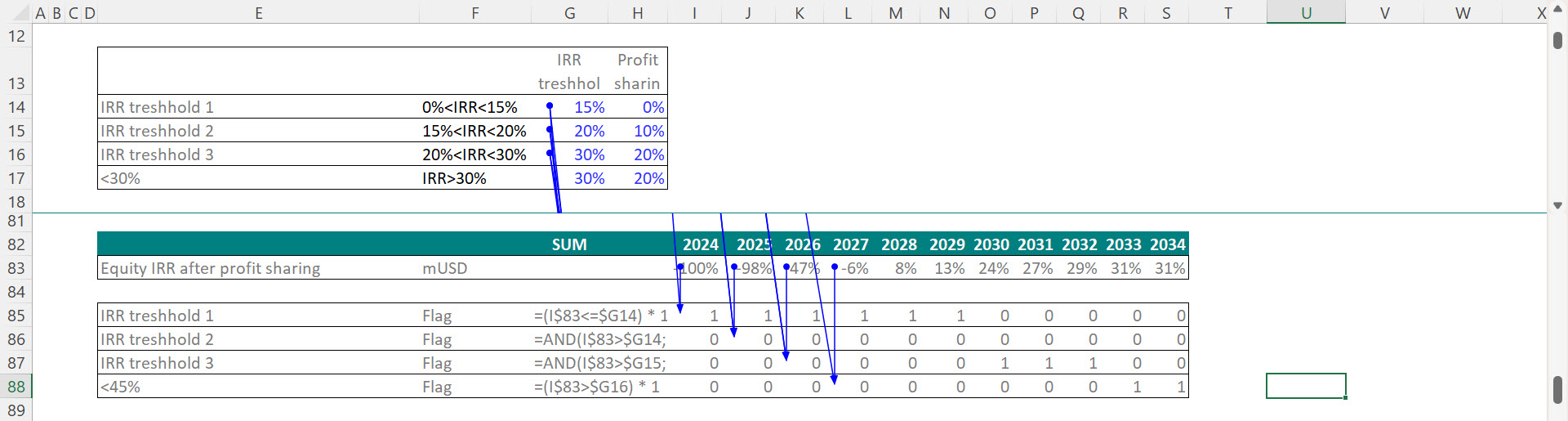

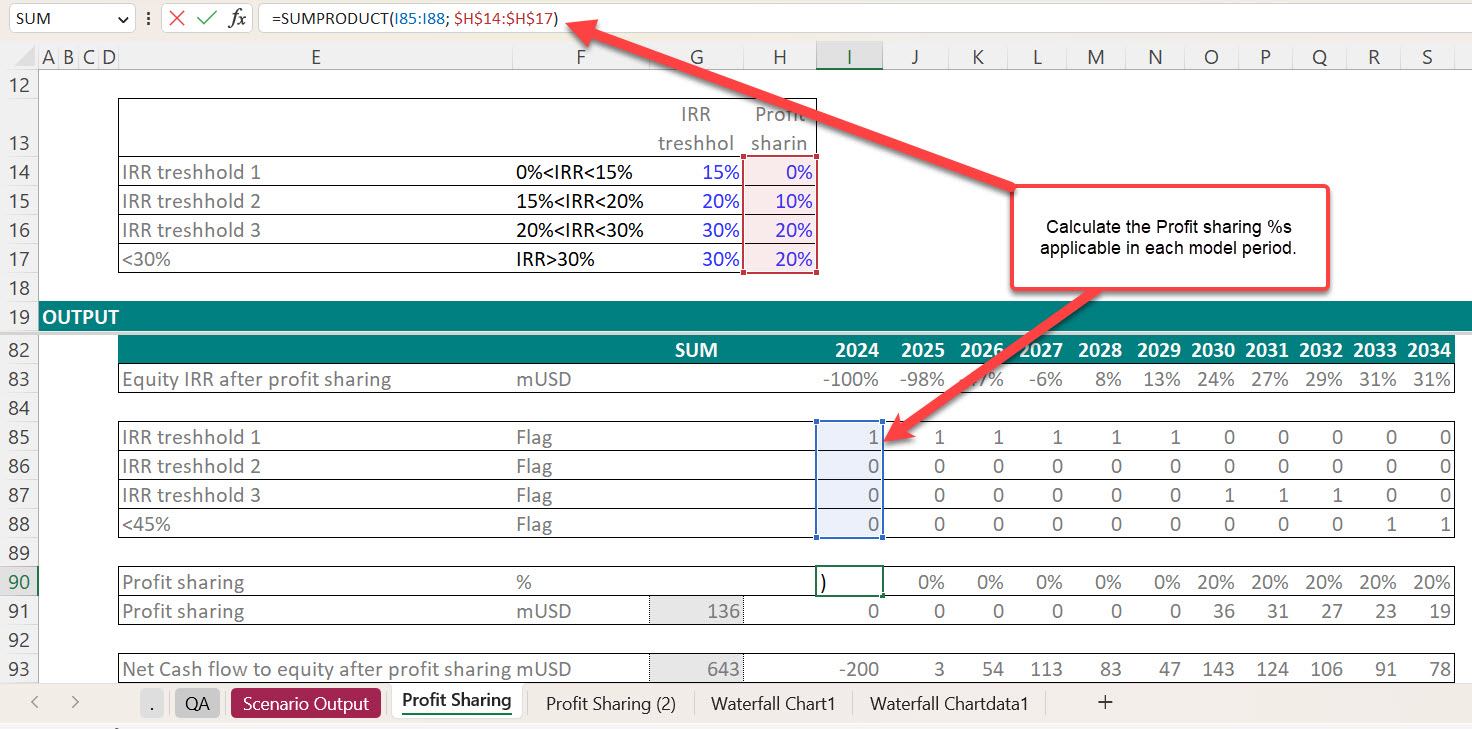

Step 1: Define the various equity IRR levels and their corresponding profit-sharing percentages.

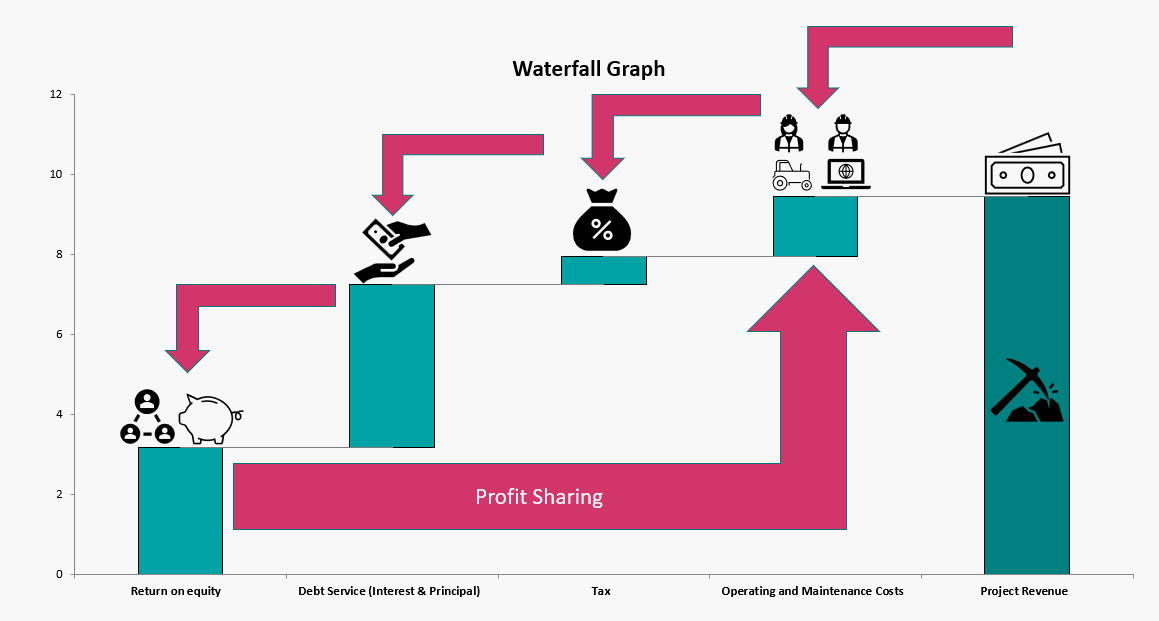

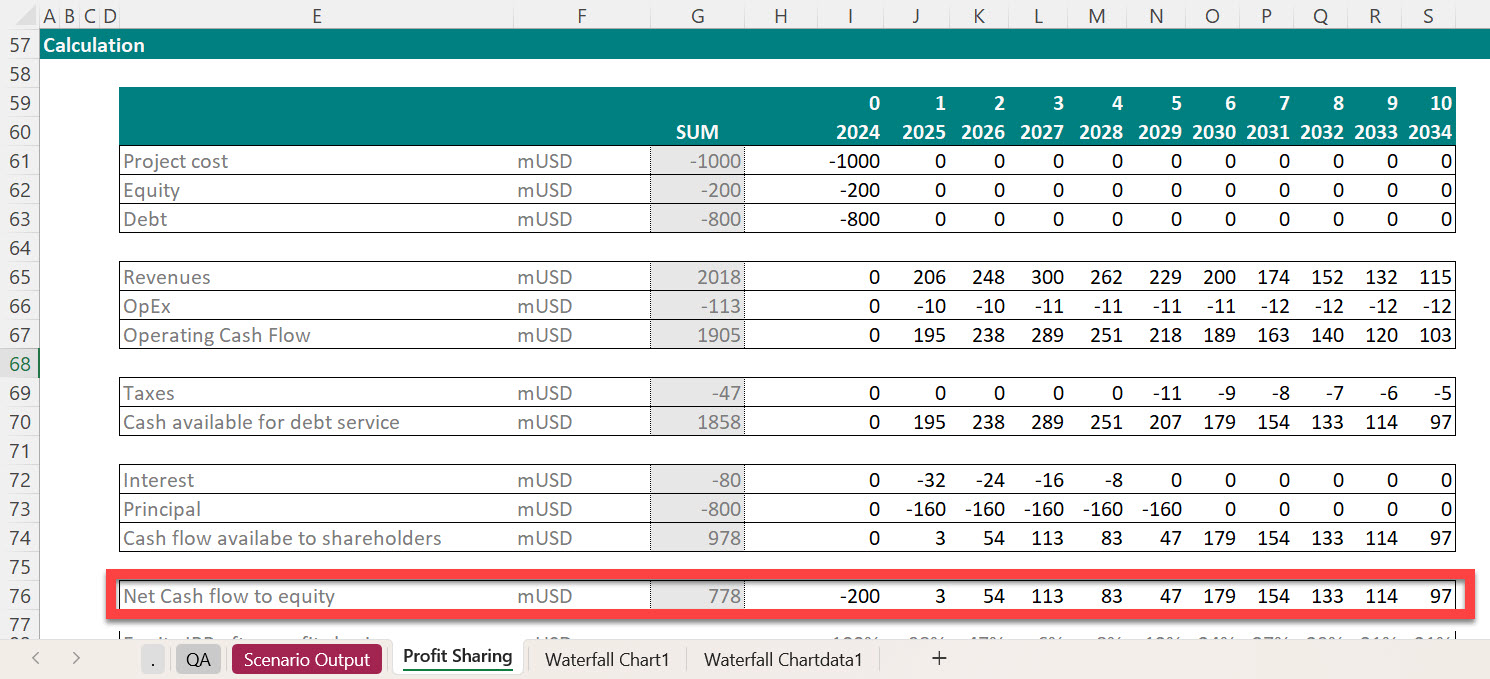

Step 2: Start with the “Net cash flow available for shareholders” from the cash flow waterfall

Step 3: Calculate the Equity IRR periodically

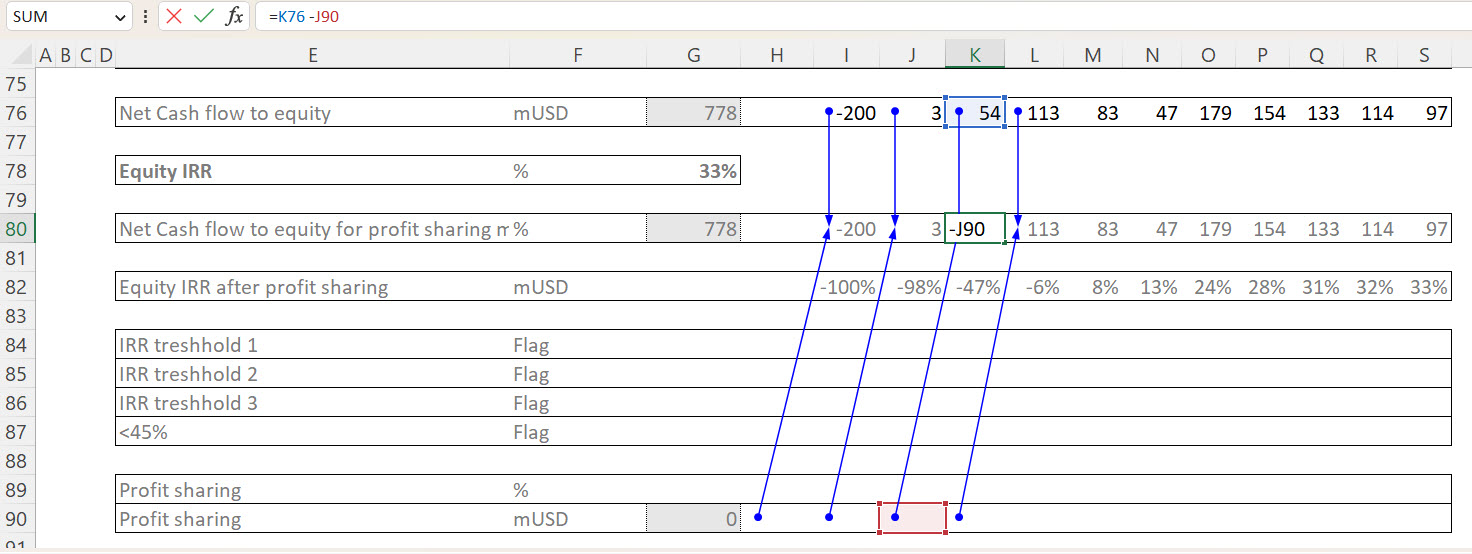

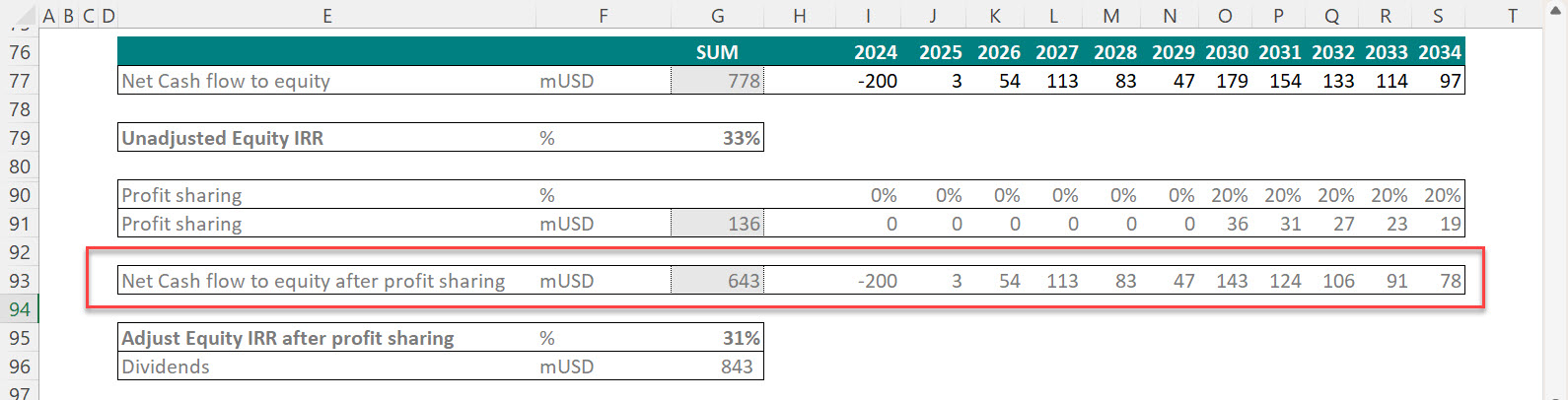

For now, create a line and call it “Net Cash flow available to equity after profit sharing for equity IRR trigger mechanism” or a shorter version!

This adjusted net cash flow (CF adj) will be the unadjusted net cash flow (CF Unadj) – the amount of profit sharing (PF) in the previous model period.

CF adj (t) = CF unadj (t) – PF (t-1)

Since you don’t have the profit sharing yet, leave it blank, and you will deal with it in the following steps.

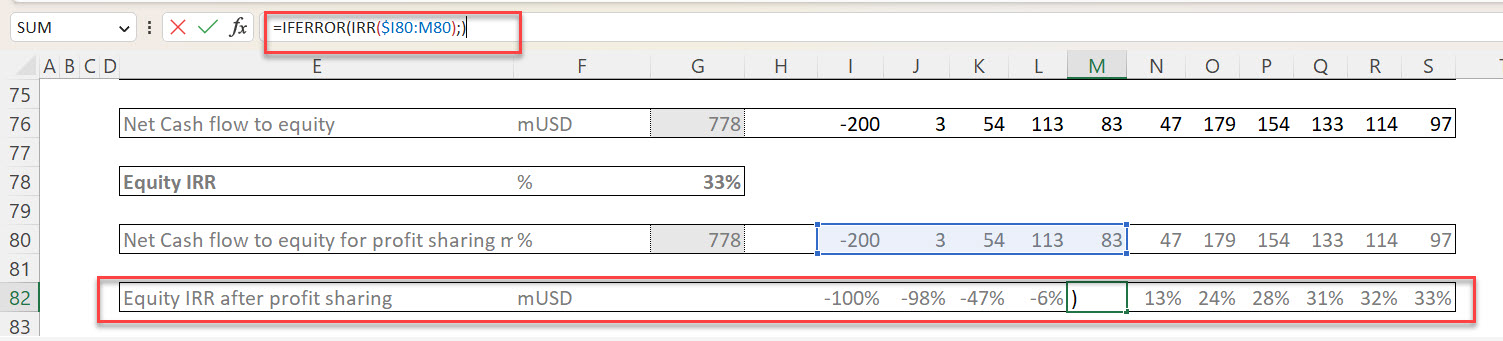

Now calculate the equity IRR periodically using the line you just calculated.

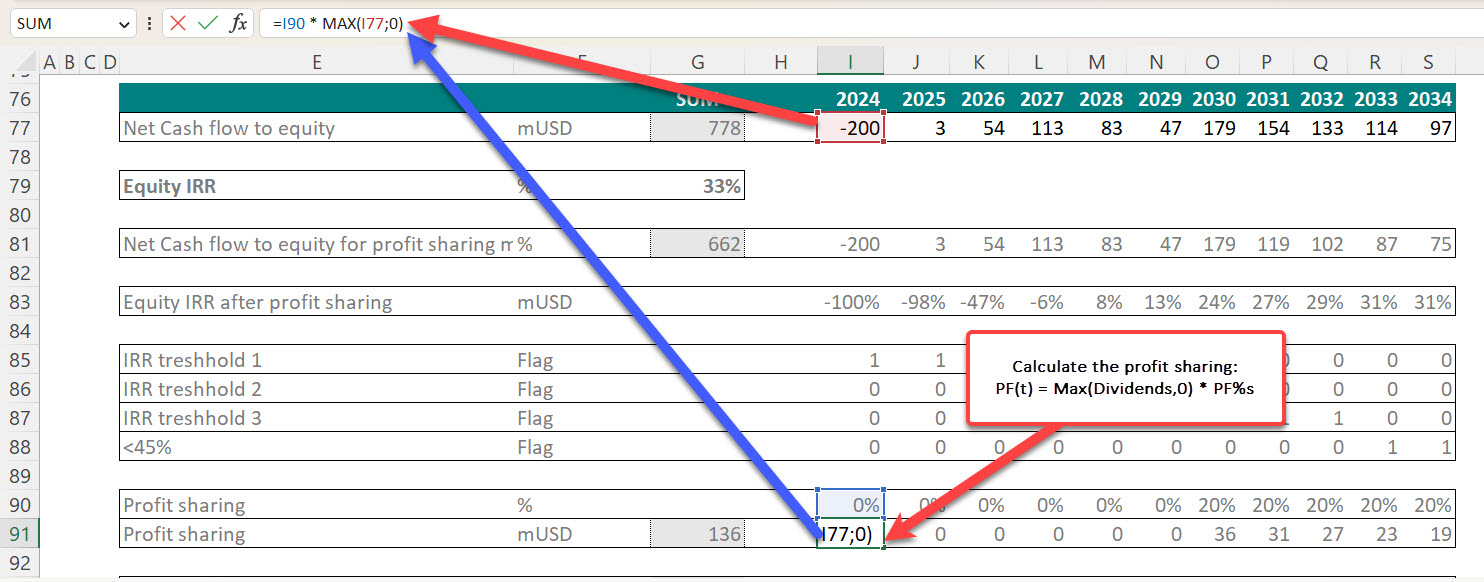

Step 4: Create flags

Create flags to depict which IRR hurdles are achieved in each model period.

Step 5: Calculate the profit sharing in each model period.

Step 6: Recalculate the equity IRR using cash flow available to shareholders after profit sharing.

Step 7: Add charts and summary tables