What is Political Risk Insurance?

A private sector has a great deal of vulnerability when it comes to political risk. Political risk can come under the below scenarios but not limited to these risks:

- Political violence; war and civil disturbance

- Currency inconvertibility and transfer restriction that limits equity to convert or transfer dividends or lenders to receive their debt service.

- Government nationalization or any discriminatory measures that makes it impossible to operate the project.

Any of the above changes will disrupt the base case model and projections and therefore is a risk that needs to be managed.

The political risk insurance (PRI) is a mitigation tools to limit investors’ exposure to the financial consequences of political risk.

For more detailed discussion on PRI, refer to below study:

Political Risk in Infrastructure Projects by Marsh

Who can benefit from PRI coverage?

There are different PRI product for different investors, but typically insure:

- Equity Investment: Both pure equity and shareholder loan

- Lender’s Debt Service: Covering interest and/or principal of debt against political risks.

How much does PRI coverage cost?

The PRI term of coverage is typically up to 10 to 15 year (can even go up to 20 years) and there’s a maximum ceiling for the guarantee amount per project. For example, for equity and loan investments, the insurer may guarantee up to 90% to 95% of the investment.

There’s no formula fit all when it comes to calculation of PRI premium. But what is most common is as follows:

For equity investment, premiums are charged on the maximum guaranteed amount and a separate fee might be charged for stand-by equity amount.

For loans, premiums are charged on the disbursed principal plus accrued interest less principal paid to date, and a standby fee is charged for undisbursed principal.

The rates and premium are project specific and depends on the country and project risk.

Other fees will be charged to cover any expenses related to the insurer processing the application and due diligence of the project.

Typically PRI premiums are payable on annual basis.

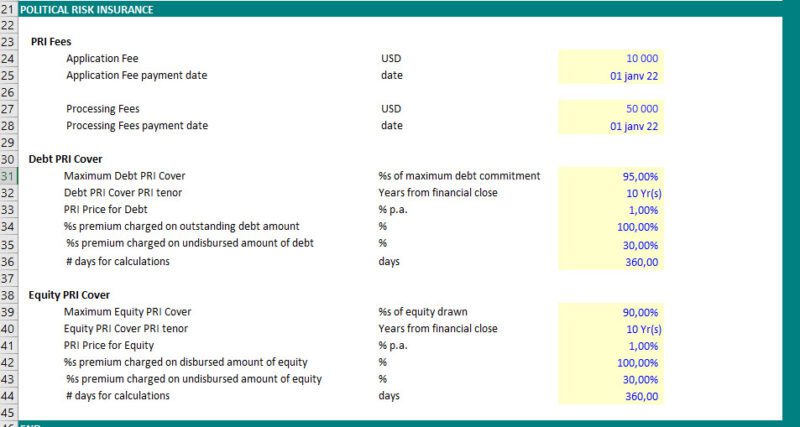

Here’s a snapshot of typical inputs related to PRI in a financial model.

Please note that there’s no single formula for pricing and calculation of PRI fees and it defers from project to project and also depends on the insurer’s requirements. However, if you don’t have any visibility on the PRI and you haven’t yet approached any PRI provider, then you can use my template as a first step in just getting the PRI into your model. However as you progress, you need to make sure that the way you have modelled the PRI premium complies with your insurer.

Download Free Template here

I know I did not cover all the issues related to PRI. If you have anything to add, please let me know in the comment. For example, there is one issue I did not cover here but it’s quite important is when you have only PRI for equity. This will then bring up discussions on who’s going to pay for the PRI cost. Lenders might not allow the project to pay and will require equity to pay for it. Even if they allow it to be paid by SPV, there will be discussions about whether to include or exclude the PRI fees in the definition of Cash flow Available for Debt Service meaning include PRI fee as opex or subordinated to debt service. There will be the same discussion about PRI fee during construction. I will end it here and again I an open any suggestion on this topic or any other topic that you want to discuss.

Take care,

Hedieh

The financial model Detective