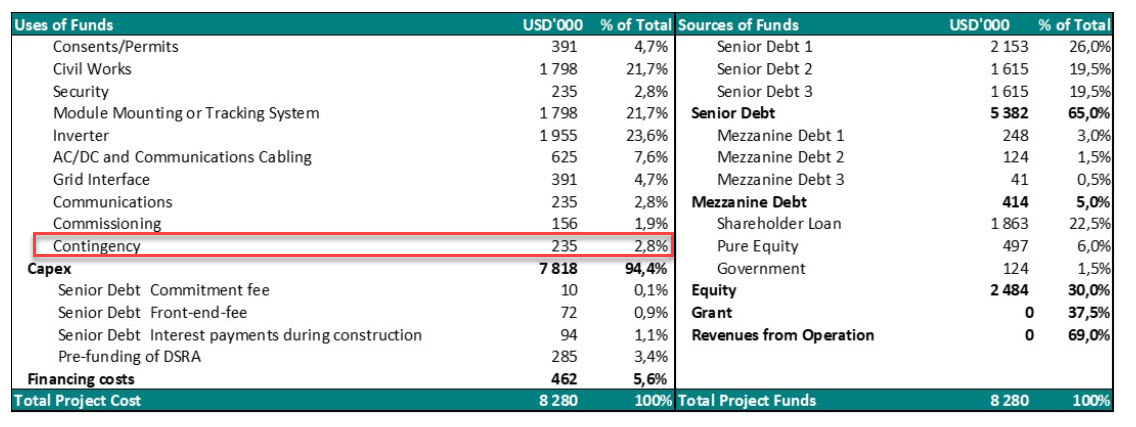

In a project finance transaction, detailed technical, financial, fiscal, environmental and other studies will be done prior to financial close to assess the risk and come up with realistic cash flow projections (base case). One of the most important statements in a typical project finance deal is the Sources and Uses of Funds Statement during construction which outlines all cost items that are necessary to bring the project up to operation and the different financing instrument available to fund the project costs. During project preparation and appraisal, all parties involved (sponsors, lenders, government, etc. ) put a great deal of effort and many consulting firms are hired to ensure that the project base costs are realistic and the project will be implemented precisely as planned. However, contingency provisions are also put in place to provide for any unexpected additional project costs during construction. Here are the different type of contingency provisions that are secured in a project finance deal:

Funded Contingency

Funded contingency as the name says is an additional cost that is included in the project budget and funded as part of the debt and equity funding. In the beginning appraisal stage, the contingency can be estimated as percentage of total project cost or a percentage of the major project cost like the construction contract cost but will be further detailed as part of the appraisal of the project. The contingency provision should be shows as a separate line item in the uses of funds (project cost) statement and be expressed as a percentage of total project cost to allow or benchmarking with other similar projects.

Sizing of the funded contingency:

How much contingency should be included in the project budget depends on:

- The Appraisal stage and availability of studies: In the early stage, where you don’t much information on the technical and risk details, you might have to rely on benchmarks and come up with rough estimates of 5% – 10% of total project cost and you need to me more conservative. As you get your hands on different studies especially technical studies (because in infrastructure projects physical costs are the main components of costs) then you can have different contingency provision for different cost items.

- Different stakeholders with different risk apatite: lenders and lender’s advisors might take a more conservative approach than sponsors and therefore, the amount of contingency required in lenders base case model might differ from sponsors point of view.

How to spread the contingency cost throughout the construction phase?

As we said contingency cost is budgeted for unexpected events. We don’t know exactly when the unexcepted even would happen. However, how you spread the contingency cost is going to affect the total project cost.

- If it is fully drawn up-front, it will bear interest and increase project cost.

- If it is fully drawn at the end of construction then it will not bear interest and will increase total project cost by the total amount of contingency cost.

- Best practice is to spread it either equally throughout the construction or to ask the construction contractor to come up with the drawdown schedule base on the riskiness of different construction elements.

How to deal with unspent contingency?

Let’s say that you have budgeted 10mUSD as contingency in the project budget but the project was completed with 2mUSD left in the project account. What to do with this 2mUSD excess cash? that’s an important topic of negotiation with lenders. Possible scenarios are:

- Any unspent contingency to be distributed to shareholders: Some lenders might allow this however, in terms of timing of the distribution, they might lock distribution to definitively after grace period and mainly beyond (at financial completion date which is usually 1 to 2 years post commercial operation date)

- Any unspent contingency to be shared between shareholder and lenders: Lenders might enforce to use all or a share of the unspent contingency to repay the loan under a cash sweep mechanism.

- If the project is in a concession or offtake agreement, then all or a share of the unspent contingency might also be used to reduce the project tariff.

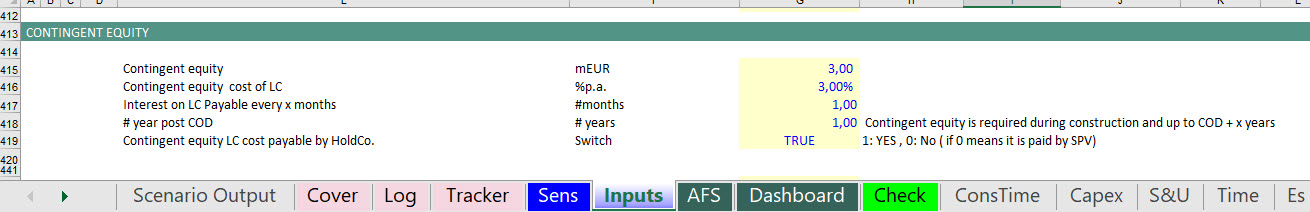

Un-funded Contingency

Un-funded contingency is mainly funded with the equity only. It is an equity commitment up to a maximum discussed and agreed with lenders that equity commits to provide on contingent basis meaning it will be drawn only if needed. some sort of security needs to be provided to lenders for the un-funded contingent equity and mostly it is backed up by a letter of credit. Then the question that will need to be discussed and negotiated with lenders is “who is going to pay for the LC cost”. Lender might agree to include it in the project budget and therefore be part of the SPV cost or they might require equity to fund it separately out of the dividends. In terms of the financial model, if you still have the possibility to change the debt sizing then in down case scenarios where you are testing for cost overrun (capex up by 10% to 20%) then the excess cost will be funded with debt and equity. However, once you have fixed the debt, then you need to model the un-funded contingency. In stress cases when you increase any model parameter that increases the total project cost, any cost overrun beyond budgeted project cost will need to be funded by equity and therefore you will need to evaluate the impact on Equity return.