What is minimum cash balance and why do we need it?

Minimum cash balance is a another form of contingency or a cash buffer for the operation phase of a project. Meaning that if there are some unplanned cash outflows, the minimum cash balance can become handy to make sure bills are paid on time. Couple of notes:

- minimum cash balance is normally not included in the definition of Cash flow available for debt service and can not be used to maintain debt ratios.

- Minimum cash balance is not the same concept as working capital account. Working capital account and the pre-funding of it serves a purpose and that is to cater for cash flow needs due to time delay in the receipts of revenues but as I said earlier minimum cash balance is a cash buffer sitting in the project account in case things go wrong.

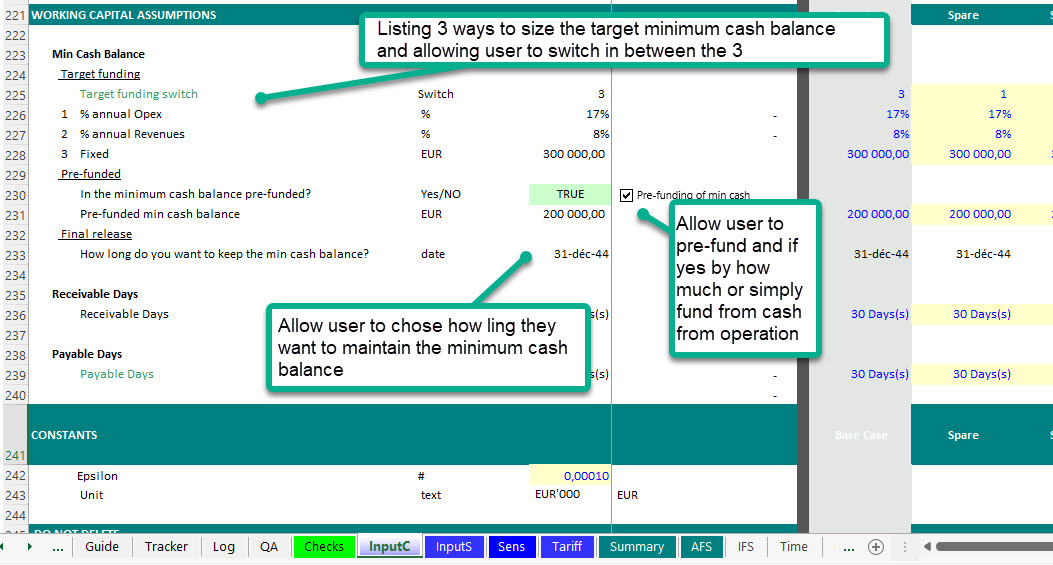

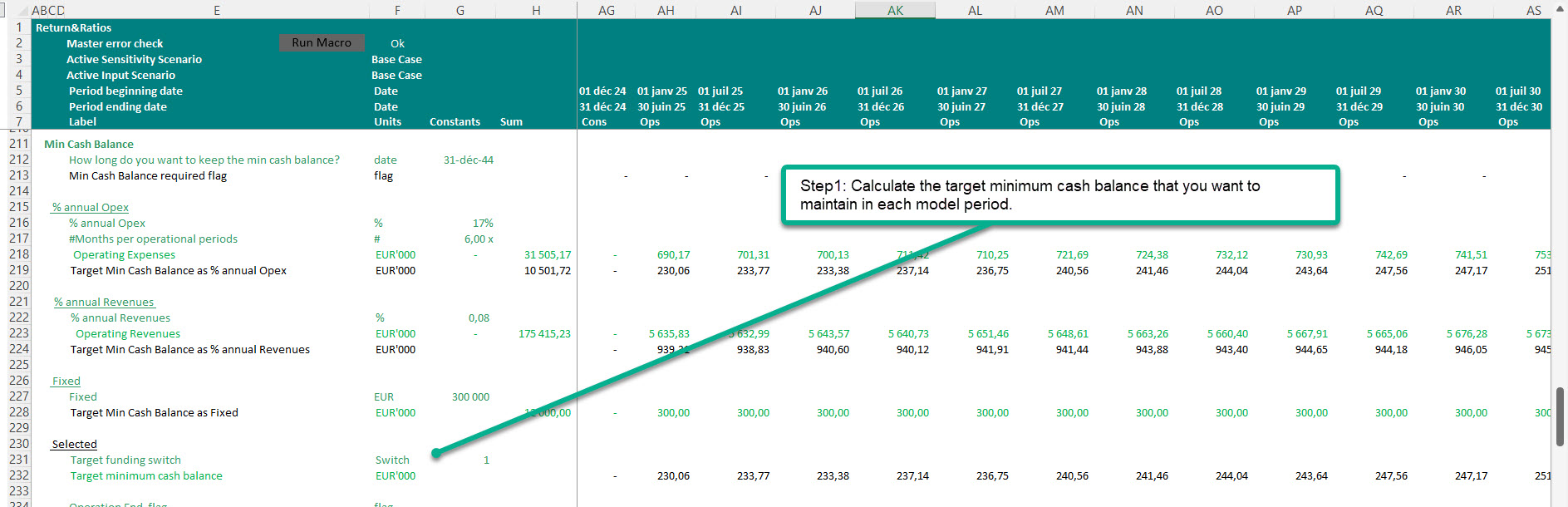

How to size the minimum cash balance?

it depends on the project however most of time the minimum cash balance is sized using the following methods:

method 1: x-months of opex or a %s of Opex (Might consider to also include debt service or at least interest in the sizing)

method 2: x-months of revenues or a %s of revenues

method 3: a fixed predetermined amount (inflated or flat)

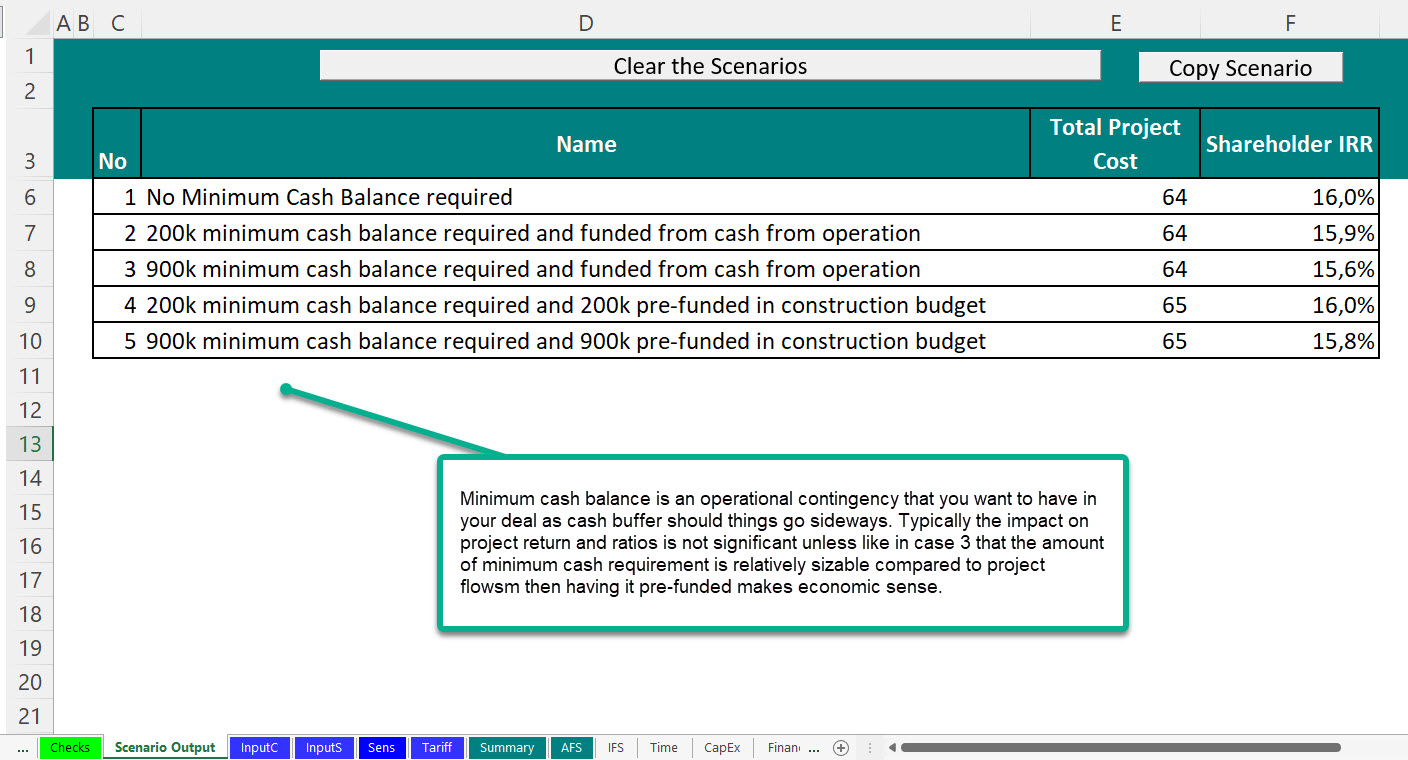

Is the minimum cash balance pre-funded or mainly funded by cash from operation?

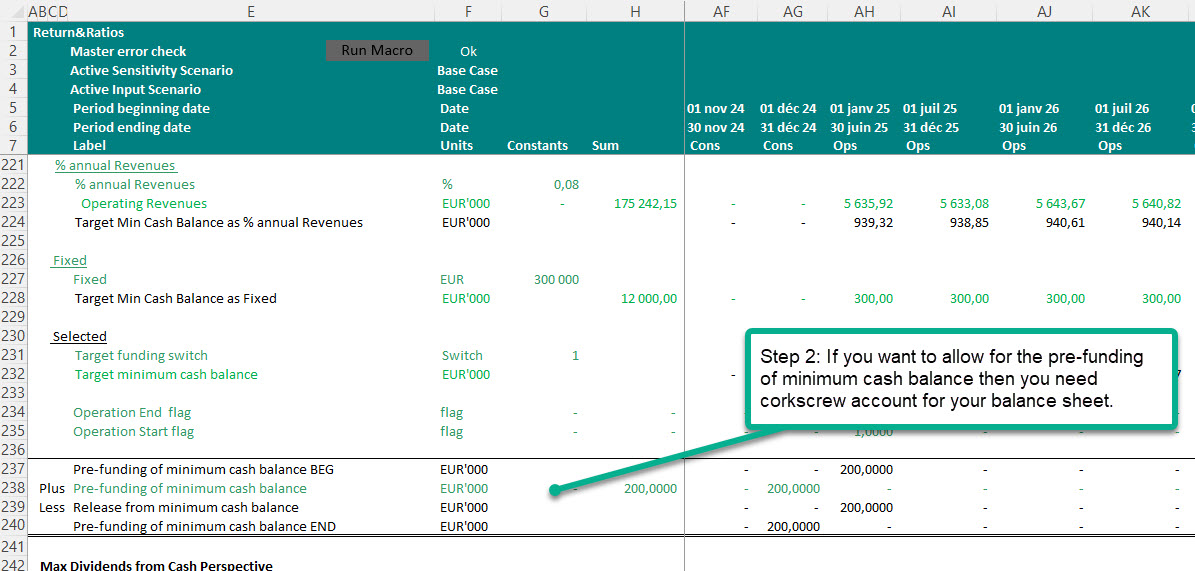

Both options are possible. If it is pre-funded, then it is included in the construction budget and funded with debt and equity. The timing of pre-funding is typically towards the end of the construction so that it has minimum impact on financing costs.

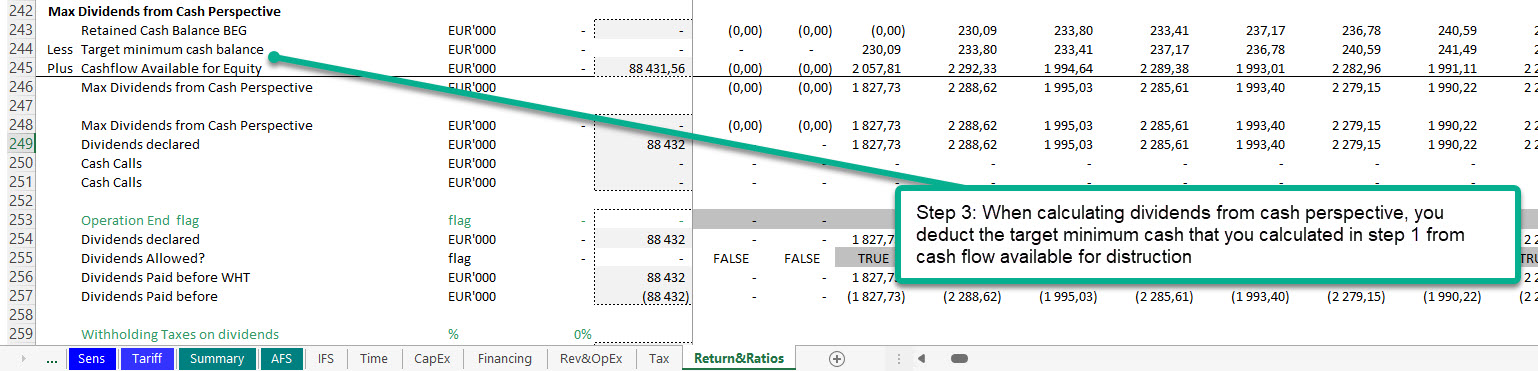

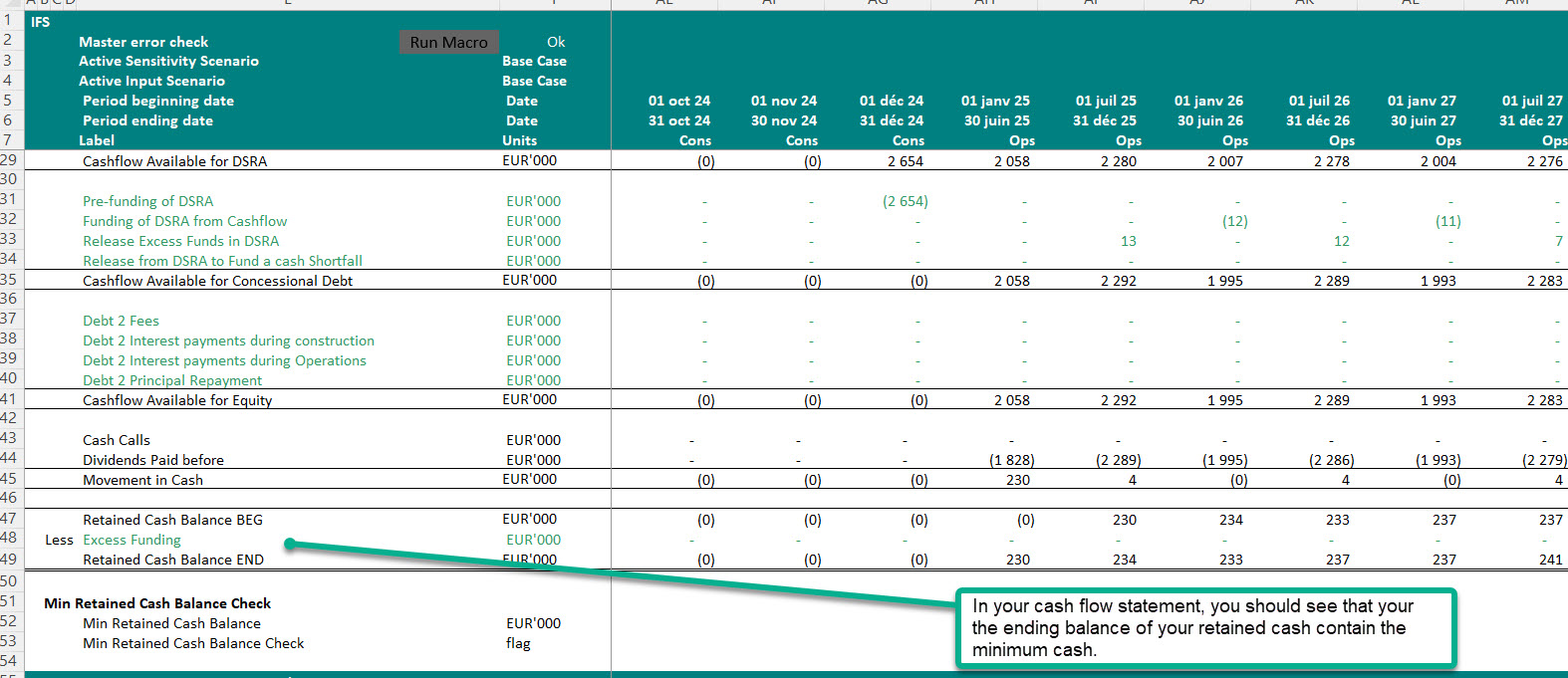

If however, it is funded from cash flow, then in term of priority in the cash flow waterfall, it is mainly funded from cash available for shareholders. Basically before any distribution is made to shareholders, the minimum cash balance is funded and maintained in the project accounts.

How to model it?

Inputs:

Calculations:

Sensitivity: