Lately, I’ve been fixated on applying minimalism to project finance modeling. In a previous post, I looked at the process of streamlining calculation blocks. This time, I want to look at a more straightforward topic – reducing the number of worksheets in financial models.

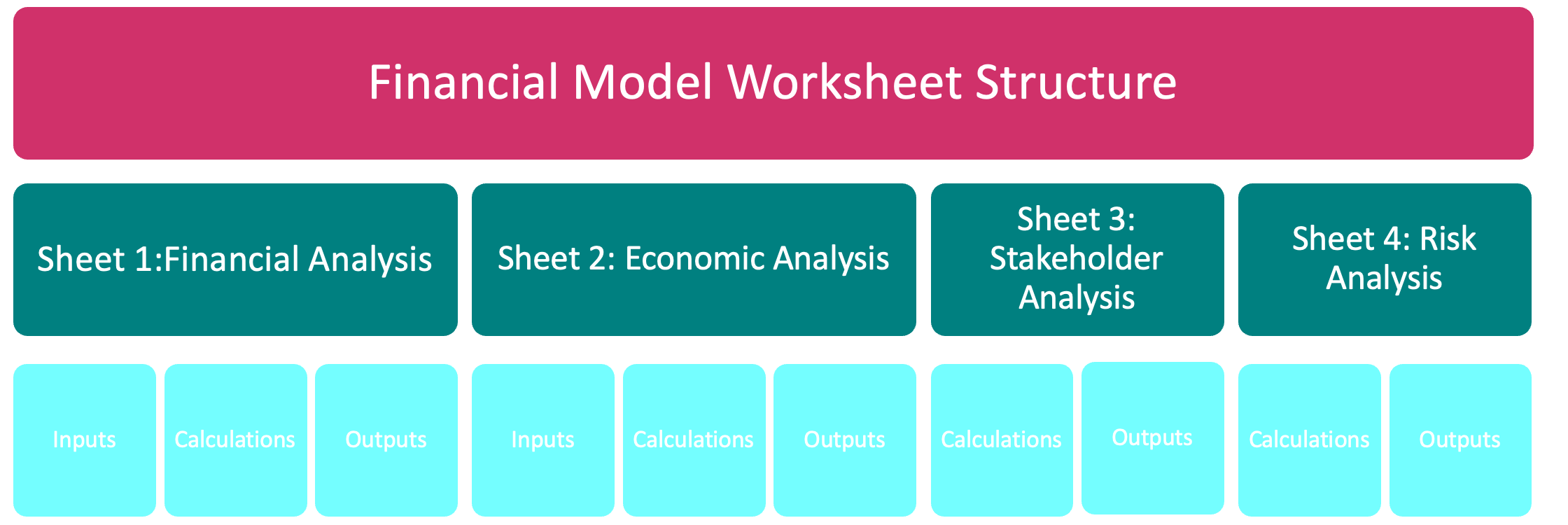

In the early 2000s, I primarily worked with development agencies. The financial model I worked on aimed to convert financial analysis into economic, stakeholder, and risk analysis. Consequently, my models featured only 3 to 4 worksheets: Inputs, Financial Analysis, Economic Analysis, and a Summary sheet.

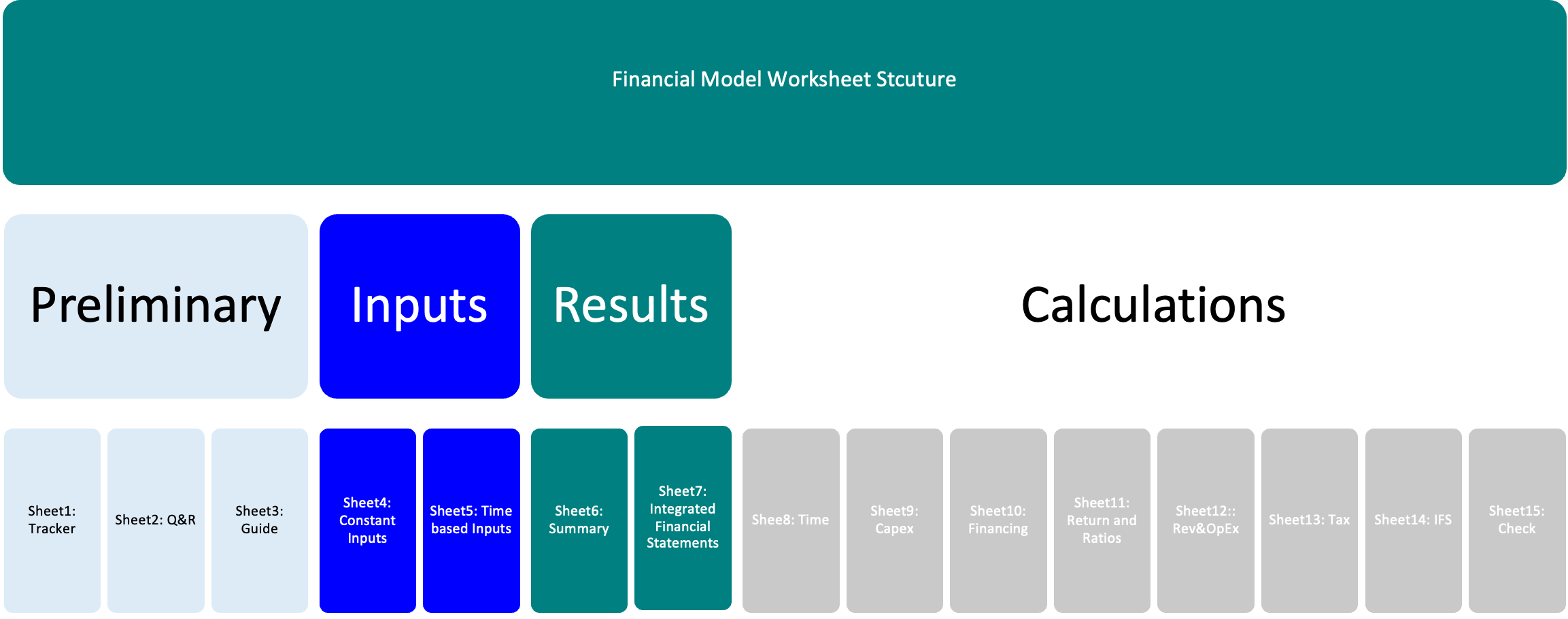

Later, my focus shifted to working with private equity funds. These entities were solely interested in financial analysis from the perspective of sponsors, lenders, and concessionaires. This shift induced me to adopt a more modular approach, separating constant and time-based inputs. I spread calculations across multiple worksheets, each properly labeled.

After more than two decades of modeling, I’m rethinking my spreadsheet design. I want to embrace a more minimalist approach. I realized that, over the years, I prioritized making my models audit-friendly. However, I’ve observed that most users of financial models shy away from diving into the details of calculation blocks. They can be overwhelmed by dozens of worksheets containing thousands of formulas and rows.

In my quest for minimalism, the first step was simplifying and reducing the number of calculation blocks within each worksheet. I’ve shared my thoughts on this in a previous blog post.

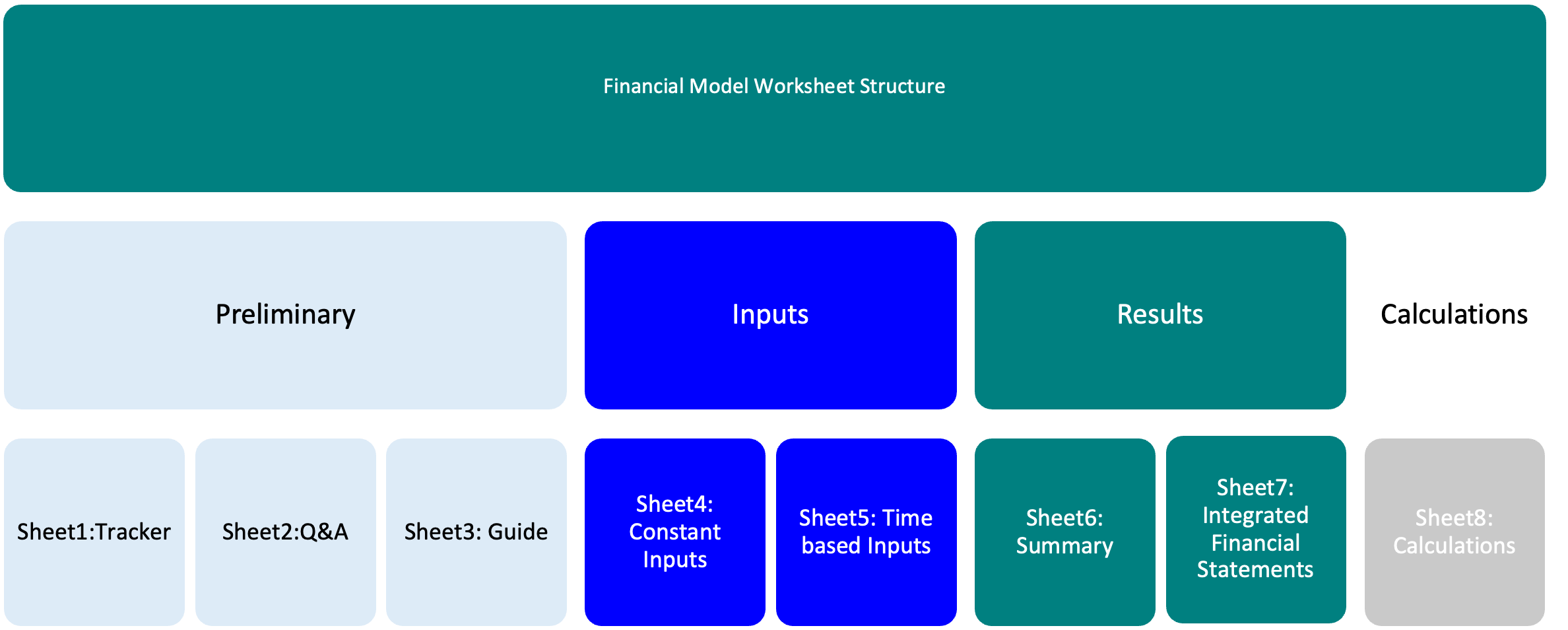

Now, for the second step, I’m reconsidering the layout of my models. A robust financial model should be as readable as any other project document, with the added benefit of dynamic functionality. The story should be evident in the Inputs, financial statements, and the Summary sheet. Additional details for those who want to dive deeper can reside in a single calculation sheet. Users proficient in Excel should easily locate the information they need within this sheet.

Your design layout should maintain flexibility and transparency. Best practice modeling standards are still essential, but focus on your end-user rather than the model auditor. Auditors and fellow financial modelers can work with any layout, but the end user, particularly one with limited Excel skills, should be your priority.

Returning to reading a financial model like any other text-based project document, prioritize readability. Place critical information in the main body of the model – the financial statements, summary sheet, and inputs. Create a reference sheet for all inputs, and make sure each input is well-documented. The calculations should serve as the “annexes” – additional details for those interested.

So, starting now, I suggest maintaining one single worksheet dedicated to calculations, even if it becomes lengthy. Users seeking details will appreciate the convenience of finding everything in one place. Of course, format your sheet with a straightforward column design, units, and sum totals, following a well-defined, easy-to-follow structure.

What are your thoughts on this approach?