To include or not include Inflation in your financial models?

If someone comes and asks me if they should be considering inflation in their projections, then the answer is “Well duh!”. If they challenge this more and insist for not including inflation then I will ask the question” why would you not include inflation in your model?”. And this is based on a real conversation I had with an advisor. The answer I’ve got was because there is significant variation over time in inflation! When I heard this answer, I wanted to say:” You don’t know if you are not dead tomorrow but it’s doesn’t prevent you from living today!” off course I didn’t say what came to my mind, instead I said, inflation is a fact that can’t be ignored, also not having inflation in the model will underestimate taxes and especially if you are using the model for setting the tariff then you are underestimating the tariff. This is well explained by John Cheong-Holdaway in the below post:

“If you’re making a real financial model, don’t make this simple mistake…” by John Cheong-Holdaway

https://www.linkedin.com/pulse/youre-making-real-financial-model-dont-make-simple-cheong-holdaway/

In this post and the video, I tell you the basics of how to incorporate inflation and escalation of different cash flow items in your project finance models.

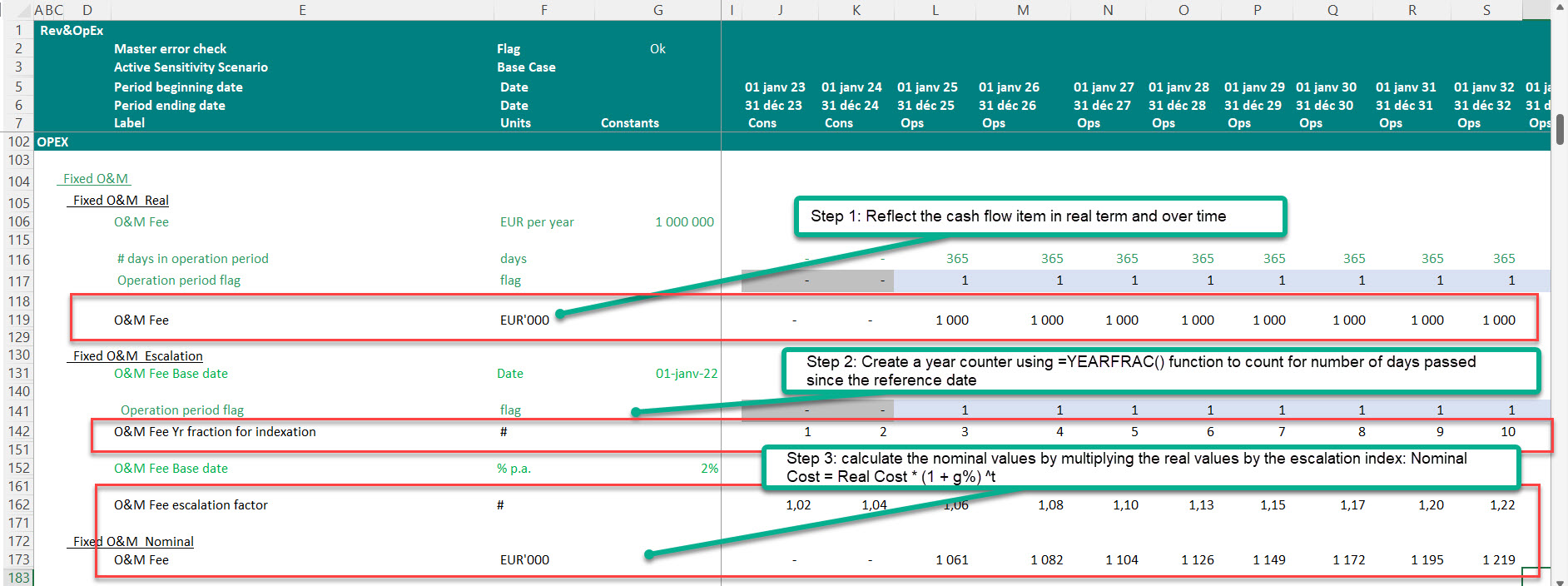

Model mechanics for including inflation into your project finance model

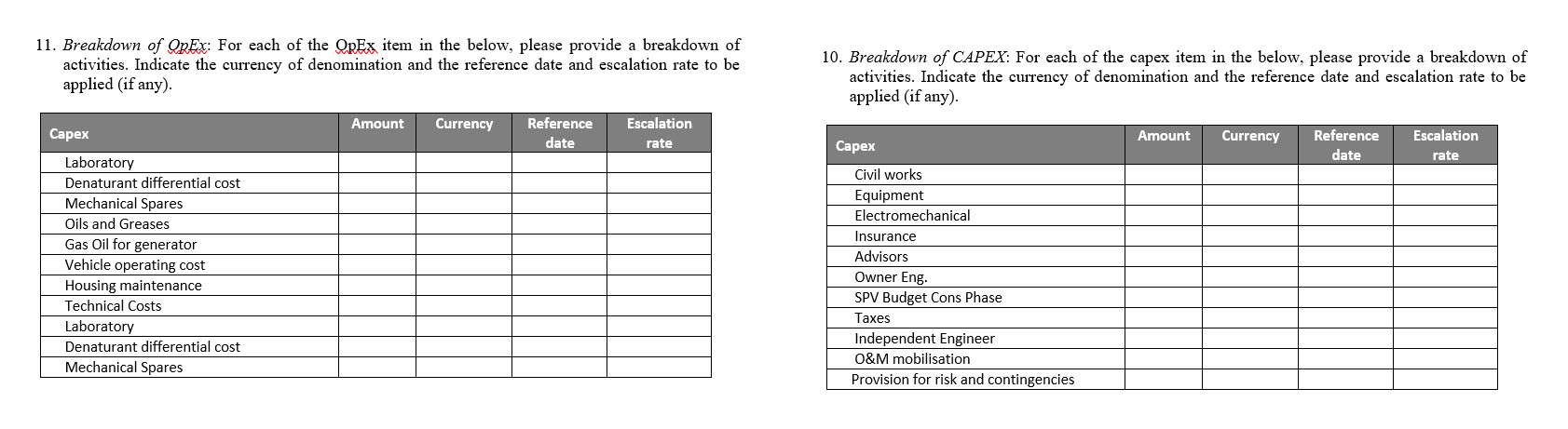

Step 1: When you are collecting data for building your model, you need to get the answers to the following questions:

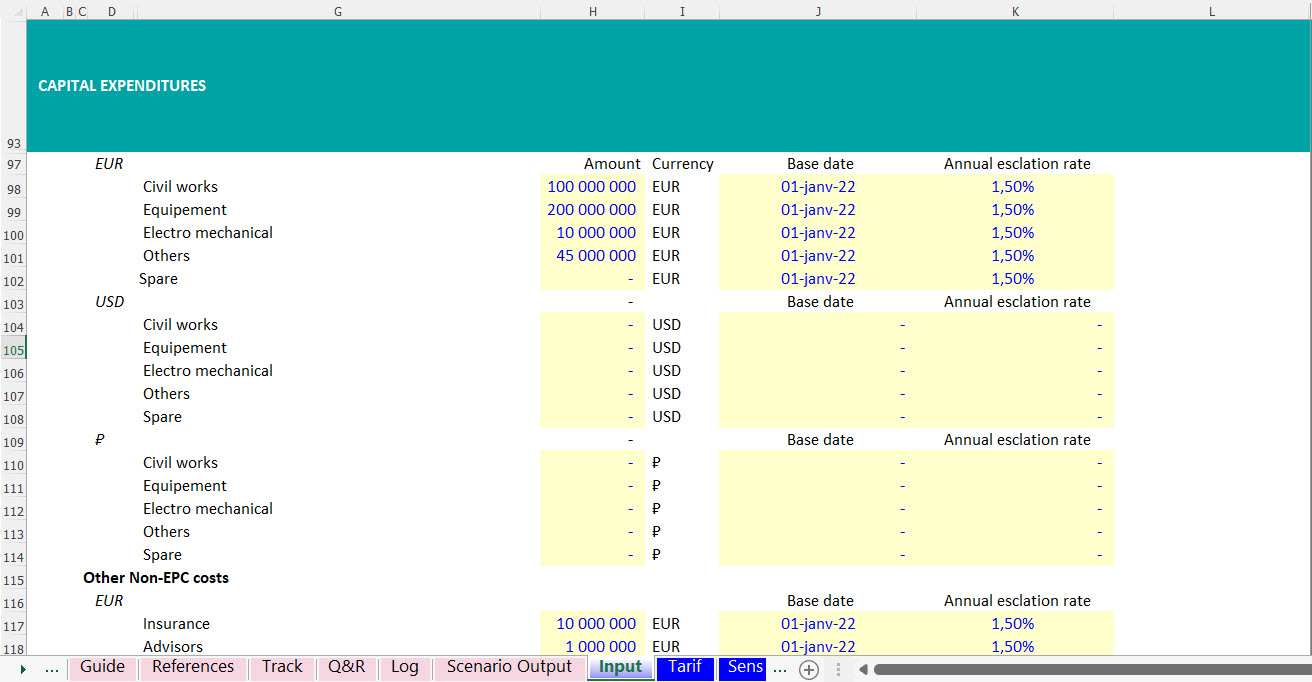

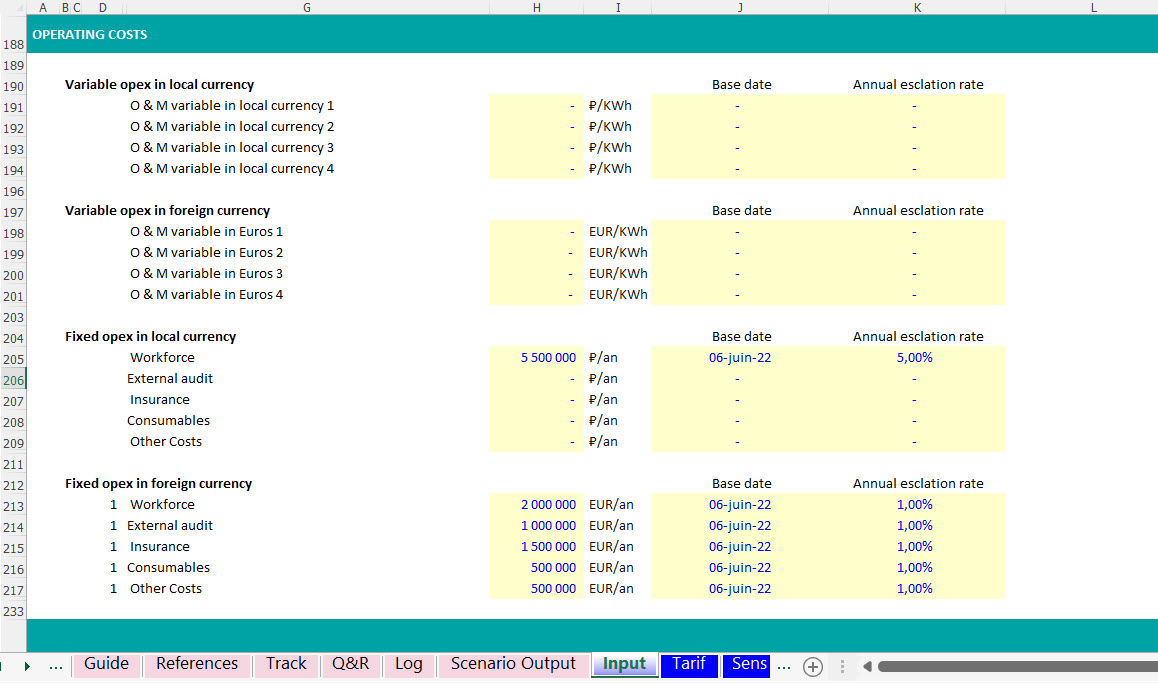

- What is the currency of denomination of project revenues, Opex and Capex and financing instruments.

- What is the reference date for the quotation you have from different contractors.

- What is the escalation rate if applicable for revenues, and all expenses.

In the last chapter of my book “The financial Model detective”, I have an exhaustive list of questions that you need to ask when building or reviewing a model and many of these questions involves getting the right currency of denomination of cash flow items and their relevant escalation rate.

Step 2: Once you have the above information then for each cash flow item that goes into your financial model, you can include the original currency of invoicing of the item, use the appropriate escalation/inflation rate and convert to model currency if necessary.

Step 2: Bring the values up to model start date using the escalation rate defined in the input and then apply the annual escalation rate accordingly. See below an example of how to turn real values to nominal values using the assumptions you have defined in your inputs: