Step 1: Why?

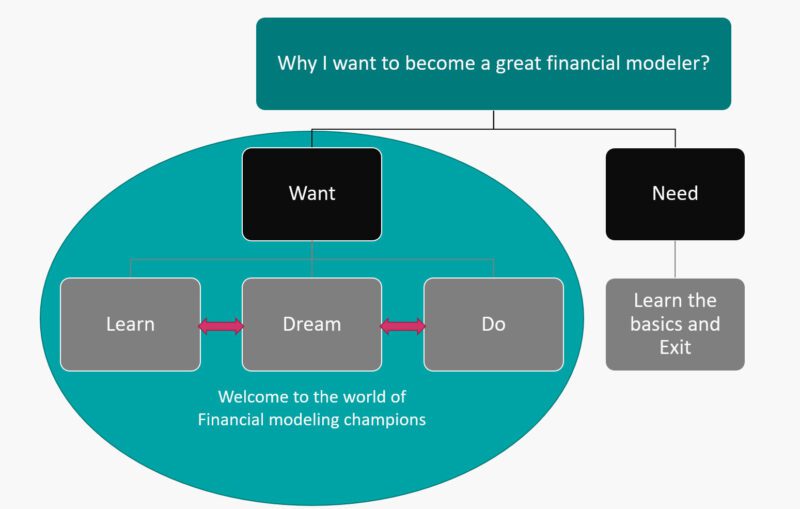

Before we proceed on how to become a great project finance modeler, I want you to answer this question:

Why do you want to become great at project finance modeling?

Which of the below answers best matches your answer:

- I want to improve my skills in the field of project finance, and I know that financial modeling is a big part of it.

- I enjoy working with financial models and want to be great at it.

- Someone told me that financial modeling is a steppingstone to higher positions, and although necessarily I wouldn’t say I like it, I think I need it.

If your motive to learn is close to answer c, then I am not sure you can go that far into learning the true work of a financial modeler in a project finance deal.

If however, your answers match a or b, you are ready to learn and you want to learn.

I insist on project finance modeling because I am active in the field and because of the sensitivity and importance of a financial modeler in project finance deals. Project finance is about future projected cash flows coming from a financial model built by a financial modeler.

My point is that, like anything else in life, if you want to be great at financial modeling, you should have the determination and the fire in the belly for it.

Step 2: Self-education

- Write down a plan on how you want to become great in project finance modeling.

- Define how much time you want to devote learning about project finance modeling.

- Give yourself a time frame for self-education before you register for any training program

- Buy the two following books:

Principles of Project Finance by Professor Yescombe

Corporate and project finance by Professor Edward Bodmer

Step 3: Contact Experts

Once you have advanced in your self-education process, find someone who is great in financial modeling or register for a course where you know you will be in touch with people who can help you advance your skills further.

Step 4: Learn by doing

The fastest way to learn project finance modeling is by being involved in a deal as the modeler, building a financial model from scratch, and being involved in the different phases of the project while you are still learning. As I said, this would speed up the learning process by a factor of ten.

If you don’t have the opportunity to work on a real deal or aren’t ready for it, create a case study and start building a model from scratch. Then come up with scenarios for yourself as if you were involved in a real deal and see if your model is flexible enough to accommodate different scenarios.

Step 5: Think beyond Excel modeling

As a financial modeler, you have to multitask:

You should be able to read contracts and understand the commercial aspects of any contract and agreement

You should understand the technical details of the project you are working on. You don’t need to know all the details, but you should have a broad perspective on the underlying parameters and risk factors as they are the drivers of your revenue line in your financial model.

You should be comfortable with tax and accounting laws applicable to your project and know where you can get the right information.

Know the main actors involved in a project deal and be able to understand their points of view.

And finally, as a financial modeler, you are interacting with different stakeholders, so you should improve your communication skills and salesmanship to be a financial modeler who can negotiate contracts.

Step 6: repetition

Every project is unique, and you will learn as you get involved in more projects and work with different teams. You can become a great financial modeler when you are great at steps 2 to 5 and keep learning while doing.