Have you seen “The Six Phases of a Project“ by Professor E. R. Yescombe? He talks about when things go wrong (and most of the time they will) and there’s a search for the guilty and the punishment of the innocent.

This is humorous but there’s some degree of truth in it. Many discussions around project finance and contracts are about how to deal with when things go wrong.

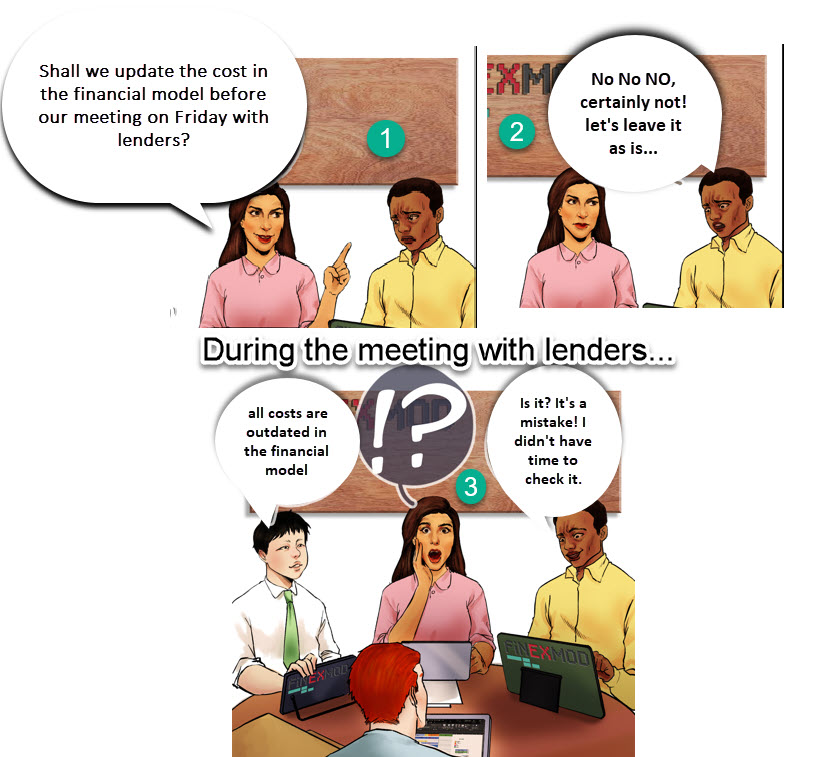

As a financial modeler, you have full control over the model mechanics, and by applying financial modeling standards you can reduce the risk of errors in your model. However, when it comes to the inputs you mainly need to rely on other people and on expert inputs and reports. Especially in the early stages of a project when the technical, legal, and tax reports are not available, most of the assumptions are internal estimations. Sometimes the financial model will use benchmarking for inputs or sometimes it will rely on information received from the team. In any case, if things go wrong then it might be the case that the finger can be pointed at the financial model containing incorrect inputs and therefore giving incorrect signals to investors.

How to protect yourself from this risk:

-

Include a disclaimer: In your model, you can include a disclaimer mentioning that you and your team do not take any responsibility for — and do not guarantee the accuracy of — the data included in the model. You can find an example online and get it checked by your legal adviser.

-

Avoid the telephone game: Inputs that go into the financial model should either be based on reports or contracts, or come from discussions or internal estimates. In all these cases, the financial modeler should have direct access to the source of the information and be involved in all discussions. I have a separate post on the “telephone game“ and why and how to avoid it. Check it out here:

-

Include a reference sheet in your model. For every input that goes into your financial model, put the reference of where you got it from. If it is from a project document, mention the filename and the page number. If you got it in an email from someone within your own team or external, mention the name of the person and the date of the email, and save the email in the folder where you keep your model. If it is an internal assumption then mention that it’s subject to further checking.

I have a template that you can include within your model to keep track of your references.

Download the free financial model DataBook and Reference sheet template

-

Mention when you last updated each input: one thing that I didn’t include in the template that I mentioned above is the date when you last updated each input. You can include these as a separate column within that template. You might do things right at one point in time, including all references, but then for months you don’t update the inputs. So it’s important for the user of the model to know when was the last time that you updated a given model.

Both measures 2 and 3 are also good ways to force you and your team to keep the model updated as you progress with a project.

I want to end this post by reminding you that the success of a deal is mainly in the teamwork. Whether you work as a consultant or a staff member within a team, you should be able to communicate easily and get the information that you need. If that’s not the case then at least using the tools I mentioned you should be able to protect yourself from legal and even reputational risks of using wrong or outdated information in your financial models.