They say if you want to get the right answer, ask the right question. How you ask the question is equally important.

During my several years of experience reviewing financial models, answering questions raised on my financial models and assisting in various contract negotiations, I understood that If you want to get the right answer, you better adopt a positive, collaborative and open mindset. Nothing is more embarrassing than asking the wrong question and accusing someone of something and later realizing that you were wrong!

Here I want to share with you a couple of tricks on how to ask better questions when reviewing someone else’s financial model.

- Replace your “Why”, with “What”: When you start a question with “Why” it’s like you are accusing someone for something. You can ask the same exact question but calibrate it differently using “What”. For example, Let’s say that you have reviewed the breakdown of project cost as reflected in the model for a project finance deal and you didn’t see any contingency being provided in the budget. So you want to ask why they didn’t include any contingency.

The why questions will be : Could you please explain why you didn’t include any contingency in the budget?

What question would be: Could you please explain the reason for not having a contingency provision in capex. Is it already included in the EPC cost estimate? If yes, could you please present it as a separate item in the budget. Normally we expect a contingency provision of between 10% to 15% for a project of this size and nature.

- Be curious but with an open mind: I called my book “Financial model Detective” and my investigation method is more like the character of Hercule Poirot from Agatha Christie meaning detailed and hyper-observant. So what I am suggesting is that you look at every single input and cells in the model but you keep an open mind and don’t jump to conclusions. For example, you see a cost item under Opex labeled “Management fees”. You can not just conclude that this fee goes to sponsors and it’s dividends and should not be in Opex. Instead you just note and then ask the question:

“Could you please explain which party receives the management fees? Is it just an internal estimation at this stage or is it backed up by a contact? We would appreciate it if you could either clarify or provide reference. Thank you.”

- Be clear and precise: I have recently gone through a series of questions and answers on a financial model I’ve built for a project. Some of the questions asked where so vague that I had to consult with a couple of colleagues and no one understood the questions. So please, there’s no need to make the question looking all fancy and complicated, just go straight to the point.

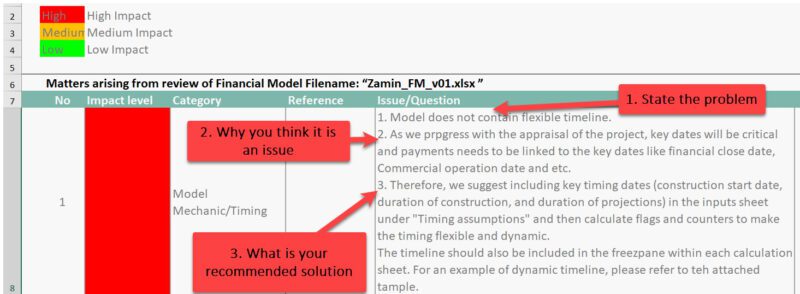

- State the problem, but also provide a solution: When you are criticizing a structure or an input in the model, state the issue but also provide recommendation. For example, let’s say that you have reviewed the model and the model doesn’t have a dynamic timeline. You want to ask them to build a flexible timeline in the model. I would say it like this:

State the problem: 1. Model does not contain a flexible timeline.

Why you think it is a problem: 2. As we progress with the appraisal of the project, key dates will be critical and payments need to be linked to the key dates like financial close date, Commercial operation date and etc.

Your recommendation: 3. Therefore, we suggest including key timing dates (construction start date, duration of construction, and duration of projections) in the inputs sheet under “Timing assumptions” and then calculate flags and counters to make the model flexible and dynamic.

The timeline should also be included in the freeze pane within each calculation sheet. For an example of a dynamic timeline, please refer to the attached template.

I actually have a template (Download)

- Don’t preach, provide reason: When you are asking for a modification or if you want to criticise something, always provide the rationale for your argument. Let’s say you receive a financial model and the model doesn’t contain any color coding and there’s no separation between hard-coded inputs and calculations. When you want to comment on this:

Don’t just say: In order to comply with best practice modelling standards, please separate inputs from calculations and also use specific color codes for cells containing inputs.

Instead you can say:

The problem: Hard-coded inputs are included in calculation blocks.

Why it is a problem and your solution: For the purpose of flexibility and transparency, we recommend to collect all hard-coded Inputs within the model in a separate section (if one pager on top of the sheet, if modular model in a separate sheet). This way we can review all assumptions and also easily make changes if necessary. We also recommend that you use a single color code (for example yellow background and blue font) for inputs. You can easily do the color coding using a free to download excel tool called “Generic Macro” developed by Professor Bodmer. You can download it from the below link: Download the Generic Macro

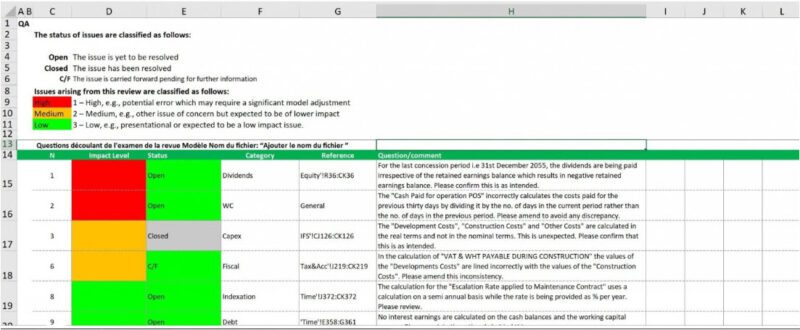

- Adopt a step by step approach to model audit: to make the task of reviewing a model for yourself and also to make it easier to then communicate your comments to the author of the financial model, try to have a systematic approach when reviewing someone else’s model. The way I do it is to first do an overall check on the model mechanics before going into the inputs and cross checking of the model with project documents. At the end of this round, I know if I want to keep the model or to rebuild it from scratch, so I will keep my comments on the model mechanics separately from questions of inputs. If the model passes the mechanical checks, then I get into the inputs. When I am preparing my issue list, for each question I ask, I put the reference in the model, mentioning the category. Please see the below snapshot as an example. You can also download my simple Q&A sheet here.

In my book “Financial Model Detective”, I included a list of 235 questions from real project discussions and review sessions. You can get your copy from here.

Get a copy of “Financial Model Detective” Book

You can also download my suggest project finance model audit checklist.

Download financial model audit checklist.

If the Q&A session is happening face to face then the best technique is to SMILE :)

All the best,

Hedieh