Possibilities for the Timing of Equity Drawdowns:

- Option 1: inject all equity upfront at the beginning of construction and before any drawdowns are made under the debt facilities

- Option 2: Pro-rata with the drawings on the debt facility throughout the construction period

- Option 3: Pro-rata with the drawings on the debt but with the %s lower than the gearing resulting in faster drawdown on equity

- Option 4:inject an initial contribution upfront with the remaining prorata on each drawdown

- Option 5:inject an initial contribution upfront with the remaining prorata on each drawdown with catch-up

- Option 6:Inject an initial contribution upfront with the remaining capital after the loan has been fully utilized

Download the Excel Template and Slides: Download Link

Option 1: Equity first

Legal language

Commercial matters

Here’s how the up-front equity drawdown works. Let’s a for a one million total project cost, $100k is to be paid on quarterly basis. The loan agreements says that equity should contributed 1oo% of it’s equity contribution up-front. If debt to equity ratio of 70:30, then equity will fund the first 3 quarters until the debt to equity ratio of 70:30 is satisfied, then debt can follow.

Notes:

- saves up some interest during construction as you start drawing on debt later

- no need for sponsor equity commitment guarantee (guarantee for the undrawn equity)

- reduces the equity IRR

Option 2: Pro-rata

Legal language

Commercial matters

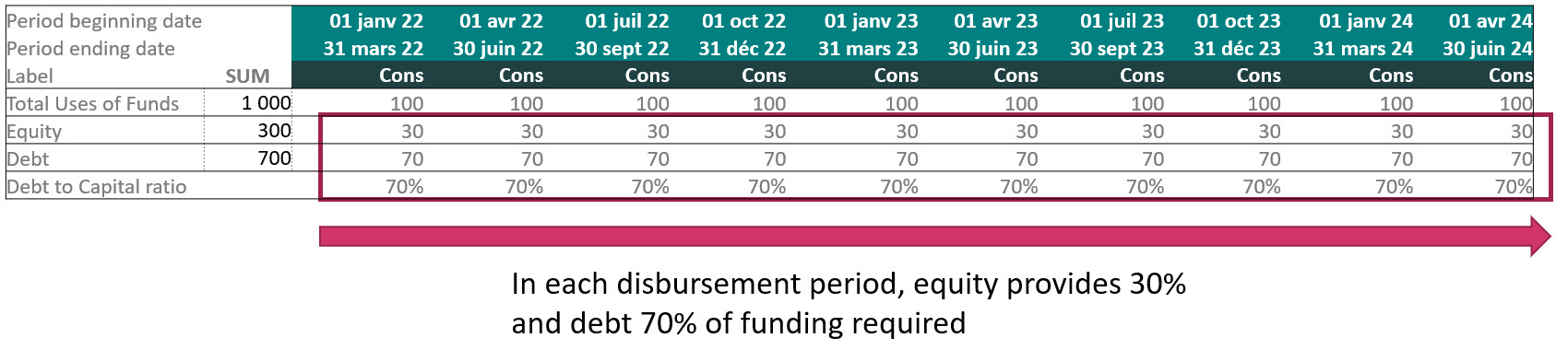

in this method, disbursements under all facilities (debt and equity) shall be pro rata

to their available commitment.

to continue with our previous example, for a 1 million dollar project with 70% maximum commitment from lenders, a pro rata disbursement means at each disbursement request the ratio of debt to capital should be 70% (meaning in each disbursement equity contributed 30 and debt 70).

Option 3: Accelerated Pro-rata (Accelerated equity)

Legal language

Commercial matters

Let’s say the maximum commitments lenders are taking is to fund 70% of total project cost. so for a 1 million total project cost, lenders commit 700 and the reaming 300 should come from equity. Now in terms of timing of injections, lenders dictates that at each disbursement, equity should provide 40% and remaining 60% will come from lenders. so in this manner, equity will be exhausted earlier than debt and after the 5th disbursement, all 300 equity is used and the remaining 5 quarters will be funded by debt.

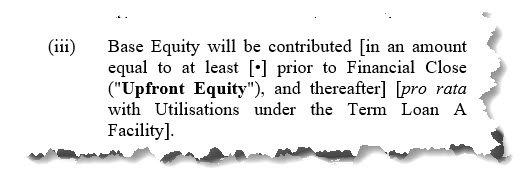

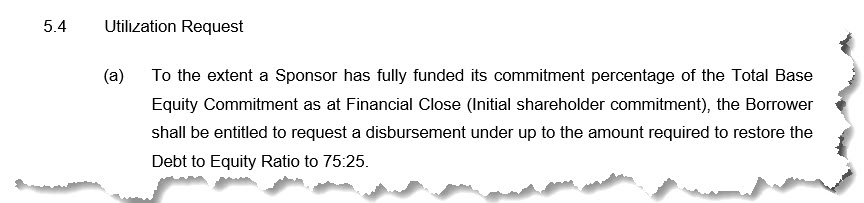

Option 4: %equity up-front followed by pro rata debt and equity

Legal language

Commercial matters

In this option, lenders require an initial contribution from equity and in this example 100 followed by 70:30 funding from debt and equity. as you can see in the below table, equity is fully committed by the end of quarter 8. the last 2 quarters will be funded with debt only.

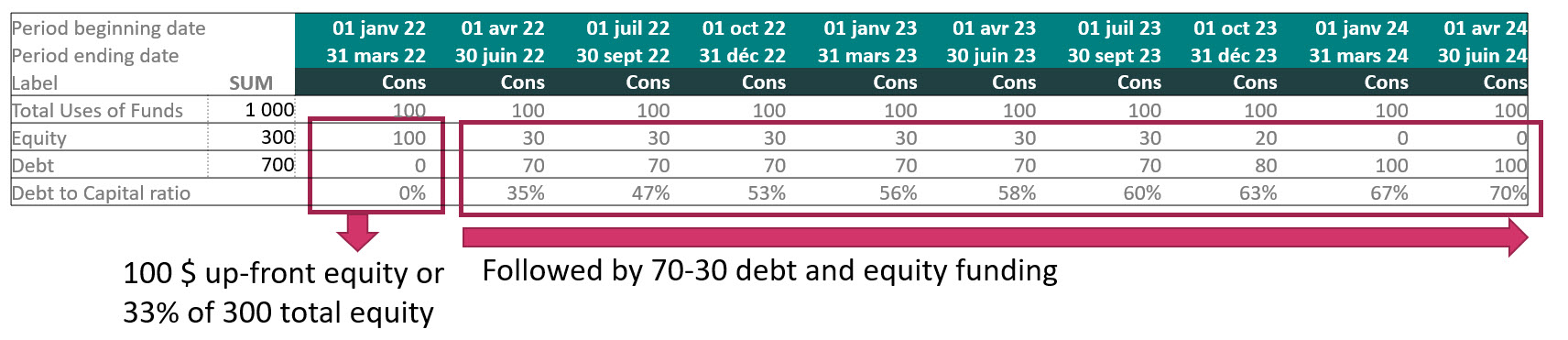

Option 5: %equity up-front followed by pro rata debt and equity with catch-up

Legal language

Commercial matters

this option is the same as the previous option but in this one, there’s a subtle difference and that is the catch up period. Professor Edward Bodmer (edbodmer.com)came up with the expression catch-up period and it perfectly explains the concepts.

In our example of 1 million total project cost, if lenders requirement from equity is to put 100k upfront, then in the next following quarters, debt financiers will need to put funds so that the 70:30 debt to equity ratio is restored. After that point, there will be pro-rata contribution from debt and equity.

Note(s):

- Results in higher equity IRR than option 4 (without catch-up).

- Make sure you understand the legal language in the loan agreement and get clarification that indeed lenders are ok with the concept of catch-up period.

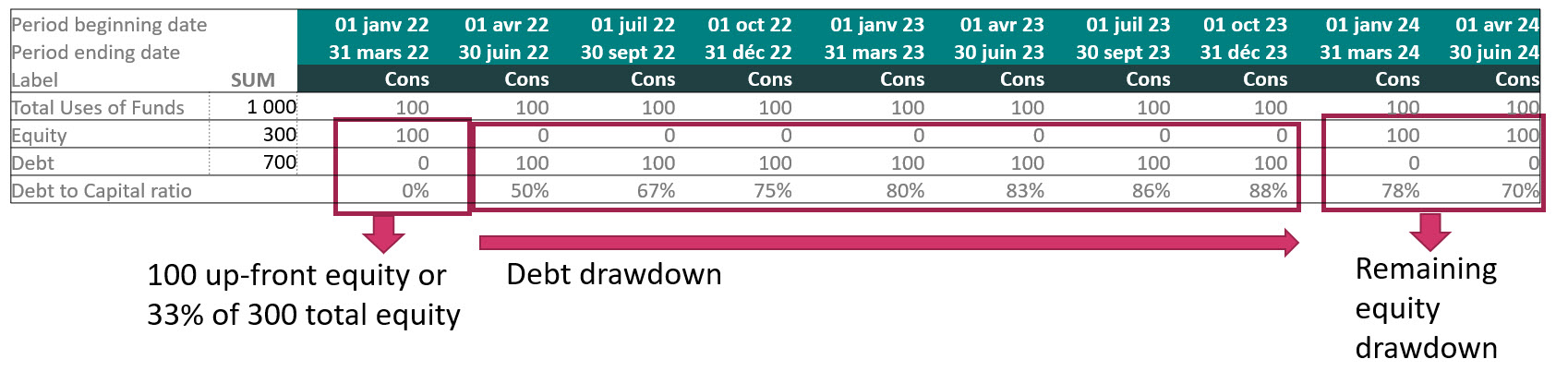

Option 6: %equity up-front followed by debt and remaining equity will come last

Legal language

I couldn’t find the exact language for this option. However, it is a good example to show another way of drafting loan agreements when comes to disbursements and that is to put the disbursement schedule as an annex to the agreement. This way you have the flexibility to define any profile.

Commercial matters

This is the up-front debt disbursement but with a option of having a percentage up-front equity requirement.

Notes:

- If %s equity coming last is more substantial that the %s up-front equity resulting in higher equity return

- Higher interest during construction

- lower commitment fees

- higher LC fee on undrawn equity

More Notes:

- When modeling different disbursement profiles, make sure that you take into consideration any limitation that any lending agency or investor might have in terms of eligible expenses to be funded by them. Most institutions have a manual for disbursement that you can download online.

- Make sure that you read the term sheet and contract with lenders when modeling disbursement profiles and attend the meetings so that you can clarify and direct the discussion towards the repayment profile that best suits your institution.

- These are not the only options but it’s a good starting point to include in your models.

- he sensitivity of investor to timing of the injection of their commitment also depends on the duration of the construction phase. If the construction is for example 6 months then equity investor might not be that sensitive in putting 100% of their equity up-front.

- You also need to check with the loan agreements about the maximum number of drawdowns and minimum amounts of disbursement in each disbursement and make sure that the model is aligned with the agreement.

- In your timeline, make sure that debt drawdowns are allowed after financial close date and not the signing date of loan agreement. However, some fees will start accruing from signature date.

Download the Excel Template and Slides: Download Link