The definition: “Contingent equity” or “Stand-by equity”

A project finance transaction structure is a limited recourse transaction meaning that in such a transactions lenders only have access to projected project’s cash flows of the project for the servicing and repayment of the debt.

But as the name says limited guarantees is required from lenders to cover some of the risks. One of these guarantees is “Contingent equity” or “Stand-by equity”.

This is mainly a guarantee required from lenders that sponsors guarantee that if things go wrong, sponsor will cover the additional cashflow requirement up to a limit which is the maximum stand-by equity amount.

The stand-by equity is sometimes requirement can in some cases go beyond the construction and required up to financial completion date which is usually 1 to 2 years post completion and operation of the project.

The story: The one with 5 million contingent LC

Background:

Sponsors will go to lenders and ask to finance 70% to 80% of their project. They put together a nice package containing all project documents including the financial model to lenders.

Lenders will review documents and get ready for negotiating their terms. One the item to be discussed is always the limited guarantees that they require from sponsors. One of these guarantees is stand-by or contingent equity.

Imagine the two parties in a grandiose meeting room…

So sponsors go back to the model and starts building the contingent equity into the model.

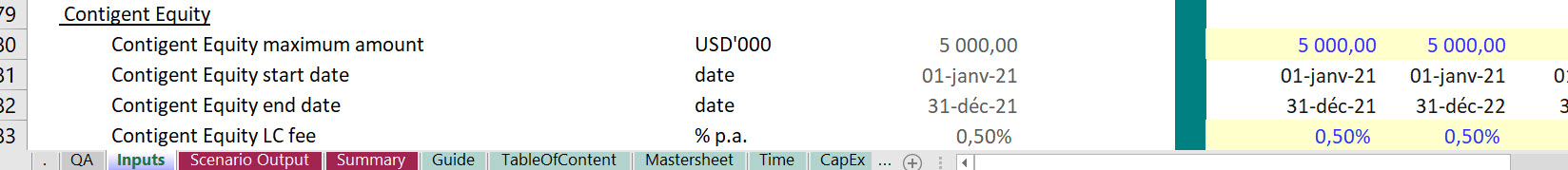

Step1: Defining the inputs

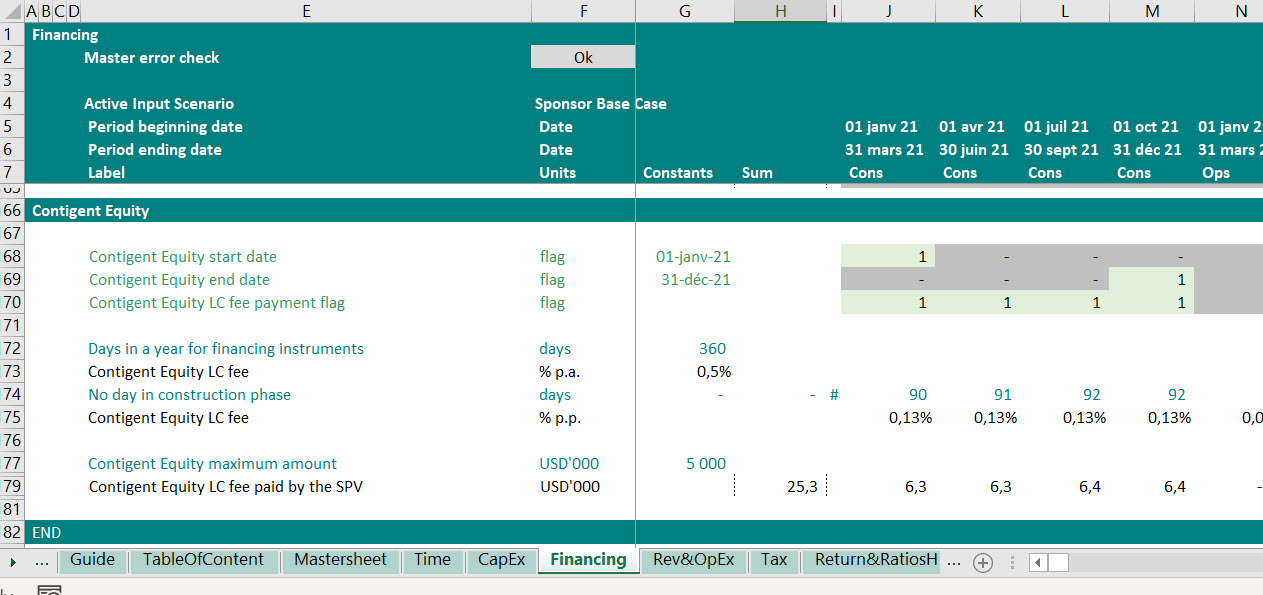

Step 2: do the calculations in the the construction sheet

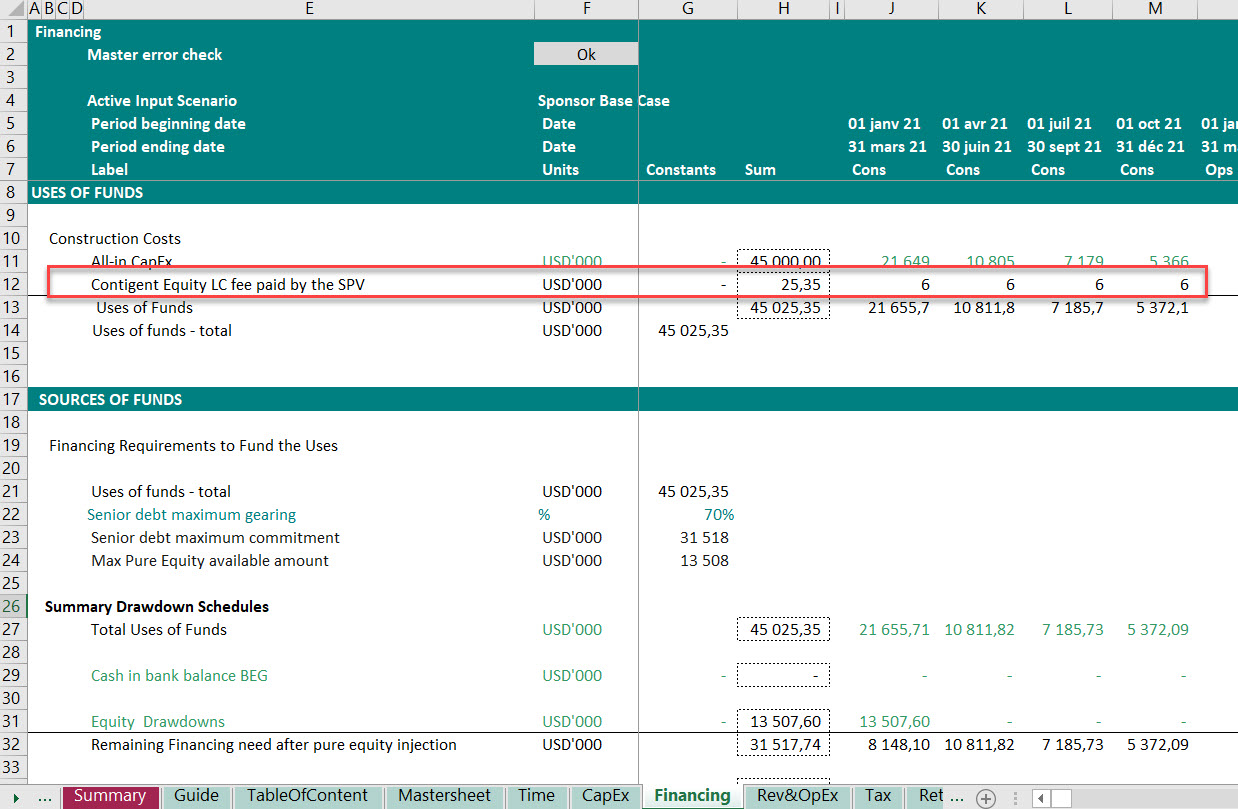

Step 3: Include the fee in the uses of funds table

Important note: if the debt is fixed in the model then you want to also drawdown on contingent equity in down cases where you have a cost overrun beyond the base case total project cost.

Few days later…

Sponsor send a revised model with the below sources and uses of funds to lenders.

…

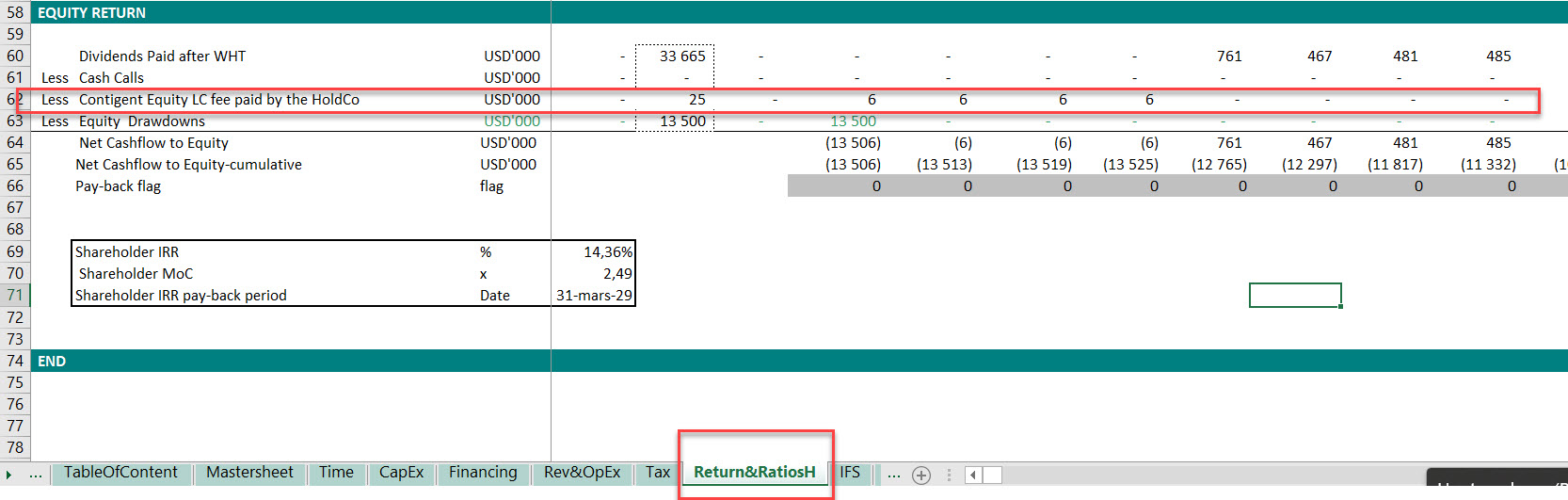

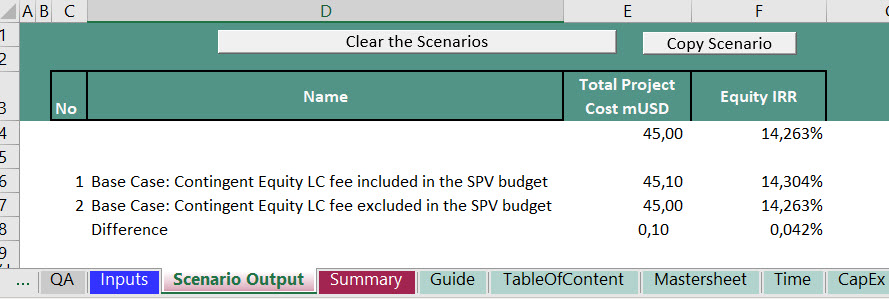

then after the meeting, sponsor go back to work on the financial model and measure what will be the impact if this on his return.

So back to the model:

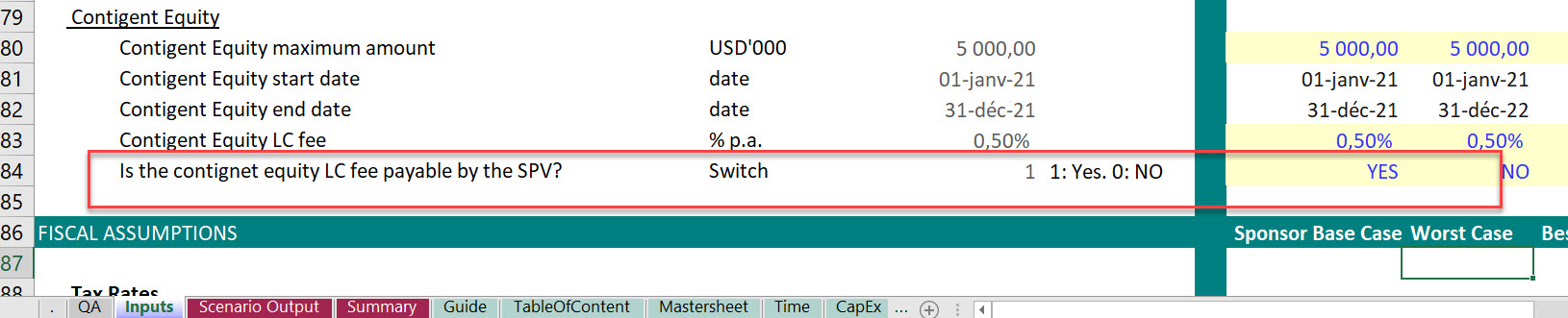

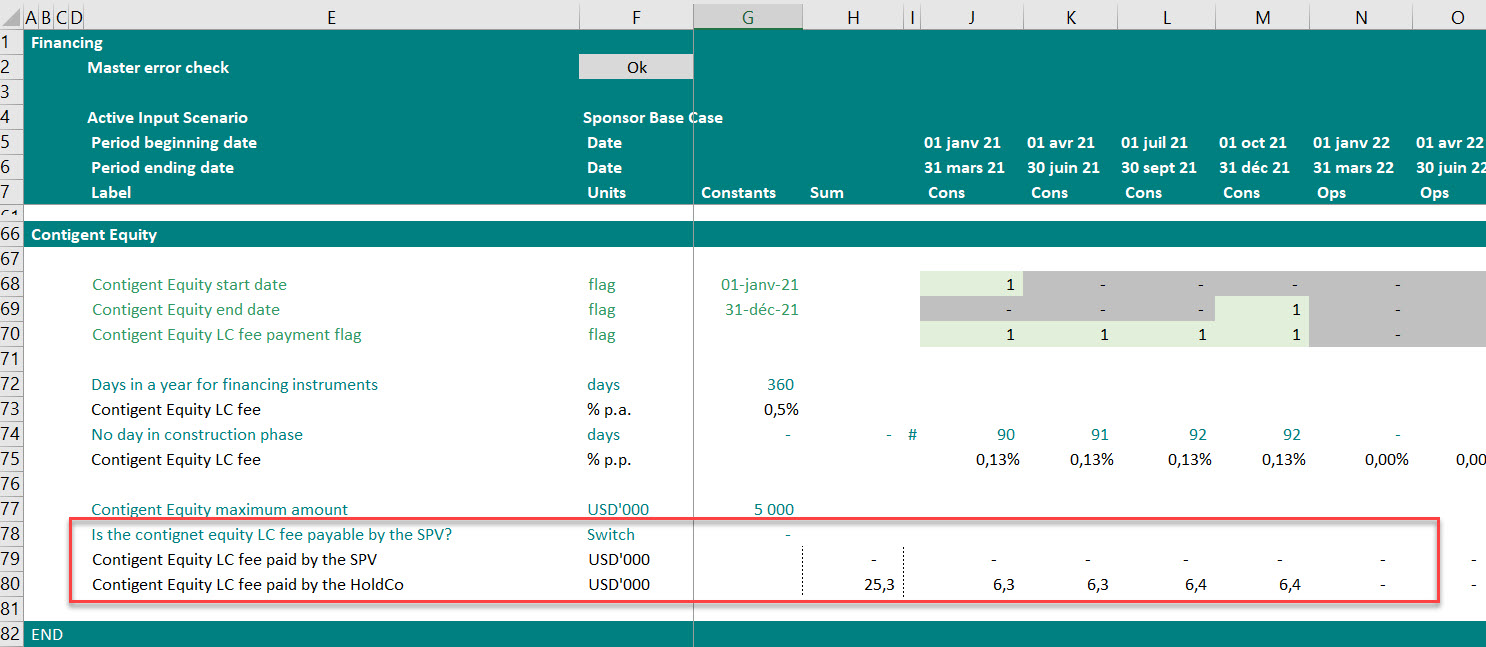

Step 1: Define an additional input

Since this is still under discussion, he will create a switch to include or exclue this fee from the construction budget.

Step 2: creates two LC fees

LC fee payable by SPV linked to S&U

LC fee Payable by Holdco linked to equity return calculation

Step 3: Run two scenarios

Download and insert scenario reporter tool into your own financial model (link to Edward Bodmer’s website)

You can also download the excel template used during video and a comprehensive manual, you can download it for free from my Eloquens channel: