I am preparing a post on debt sculpting and while preparing it I realized I need to also cover the concept of weighted average life of the loan or average life of a loan because I will use it in my debt sculpting exercise.

So this is going to be simple and hopefully short.

What is WAL?

Weighted average loan life or average loan life is measured by years.

It is the average time that it takes for the principal to be repaid.

How to calculate?

As the name says, you give weights to each principal repayment due at each calculation date.

The first repayments will have a weight of 1, the second repayment will have the weight of 2 and ainsi de suite …

Now let’s look at couple of examples:

Story: we have 100 mEUR loan to repay within 5 years.

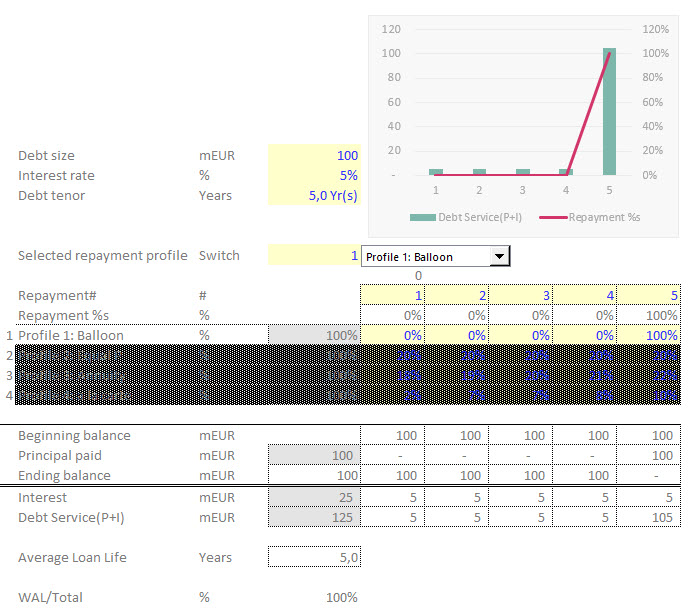

Example 1: Balloon payment:

We pay 100% of the loan in year 5.

WAL = ( 0 * 1 + 0* 2 + 0*3 + 0*4 + 100*5) / 100 = 5 years

so in balloon payment, WAL = Total number of repayments

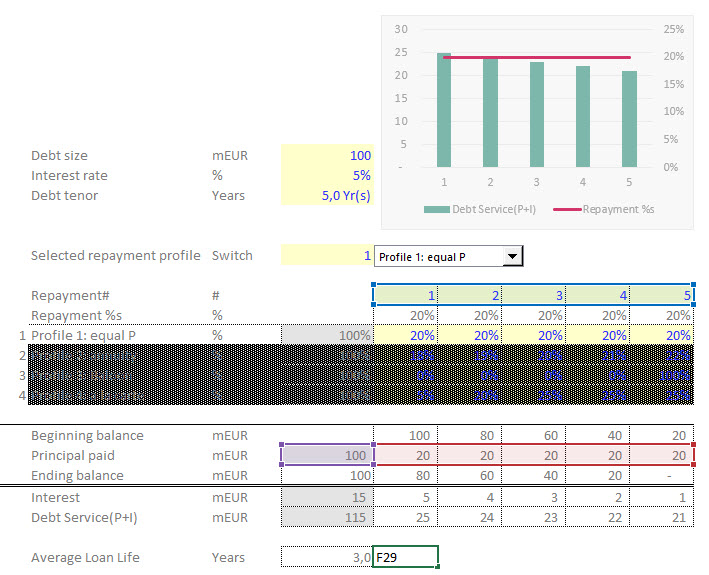

Example 2: Equal principal payment:

WAL = ( 20 * 1 + 20* 2 + 20*3 + 20*4 + 20*5) / 100 = 3 years

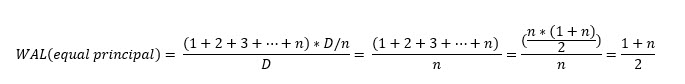

If we do the math, for equal principal repayment the formula can be simplified into the below form:

One thing you notice when you convert the WAL formula if repayment is equally sculpted is that in this payment terms, WAL can never be below 50% of the total number of repayments.

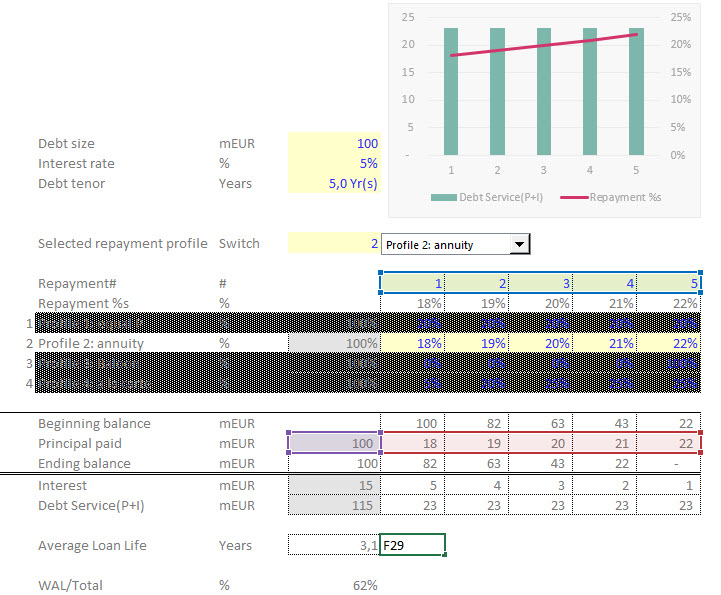

Example 3: Annuity payment:

Annuity repayment method is when your bank requires you to pay equal debt service (principal + interest) installments over the life of the loan.

In our example, banks required 13mEUR of interest plus principal over 5 years.

WAL = ( 18 * 1 + 19* 2 + 20*3 + 21*4 + 22*5) / 100 = 3,1 years

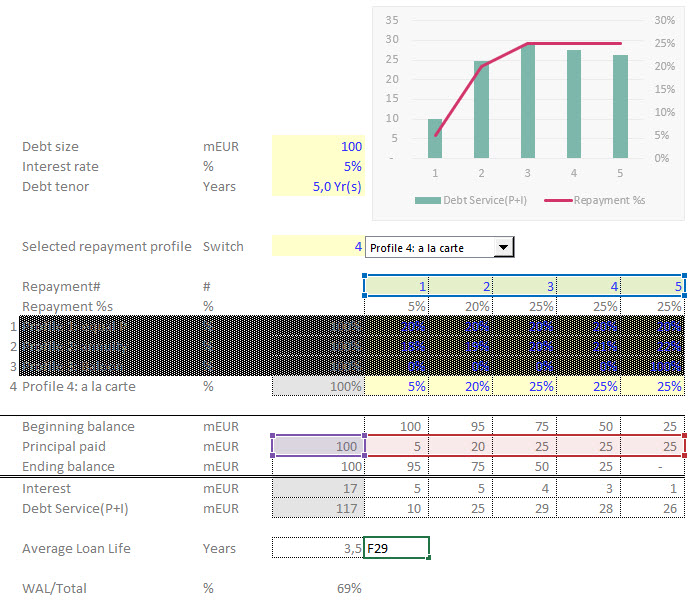

Example 4: Sculpted principal repayment

Now let’s look at a situation where the lenders do not impose annuity, ballon or equal repayment of the loan but they give flexibility on how you want to pay back the loan. Of Course they will impose limitation but this will be the topic for next week’s post.

Let’s come up with a repayment profile that is pretty much backloaded.

WAL = ( 5 * 1 + 20* 2 + 25*3 + 25*4 + 25*5) / 100 = 3,6 years

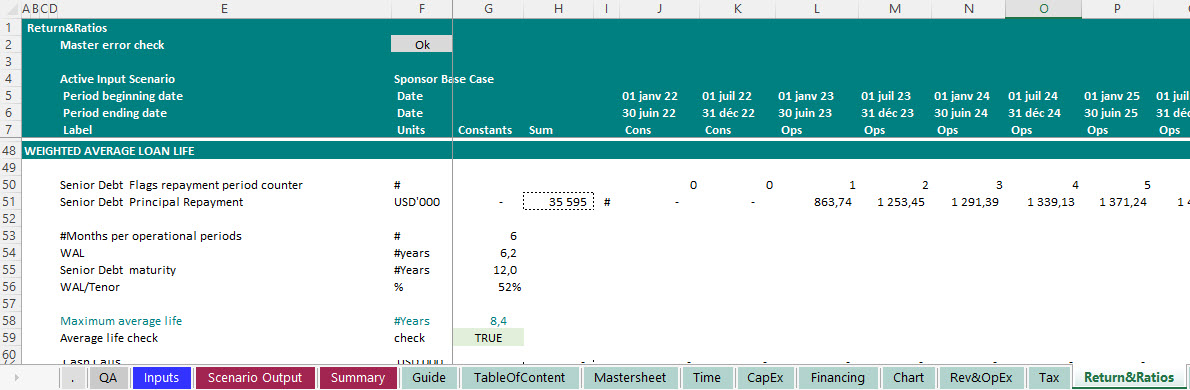

So in conclusion WAL is another debt metric that you want to include in your financial model and report it in your dashboard/summary sheet.

Also check in the loan agreement and see if lenders impose a maximum weighted average loan life that you need to maintain. If this is the case, then you need to reflect it in the financial model and create a check that can inform user that the average loan life is or is not within the acceptable range imposed contractually by lenders.