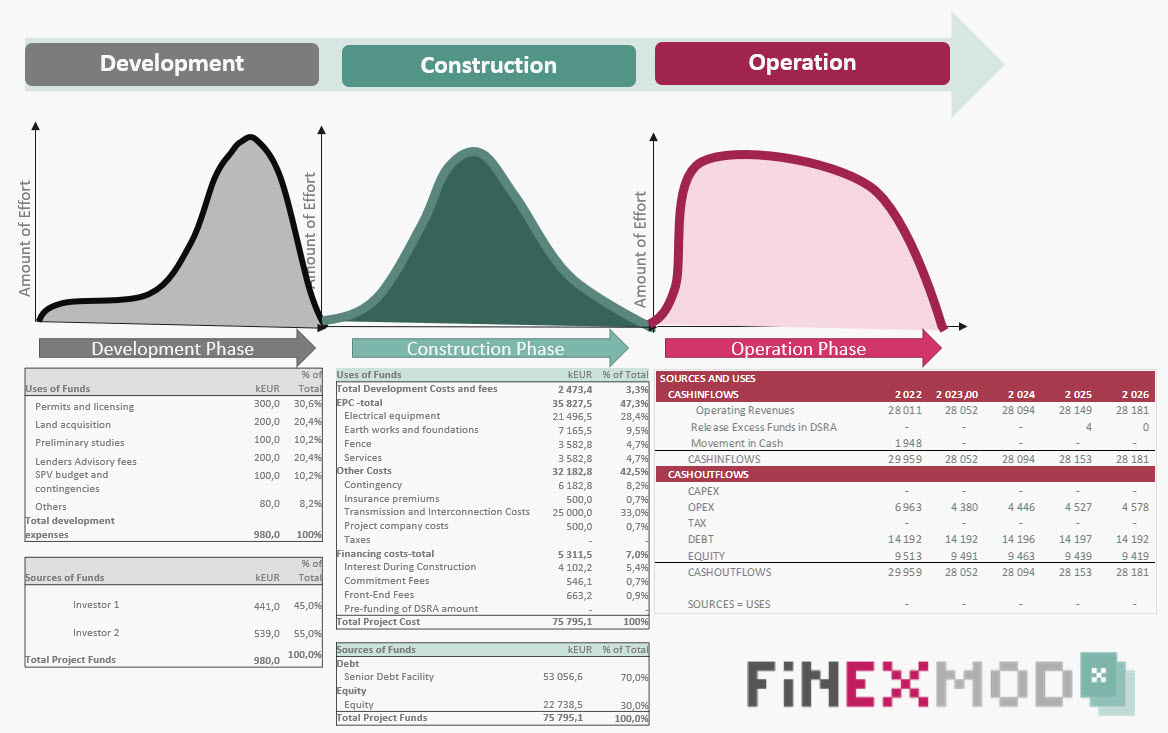

Developing an infrastructure project is a process involving many stages and it starts with the development phase. It starts with an idea or identification of an investment opportunity in the mind of a developer or group of developers.

They then carry out different rounds of technical-financial assessments and obtain land and all required permits and licenses, select a contractor to design and construct the project ( i.e. EPC), and as the project moves from one stage to the next, the feasibility studies become more and more detailed until the project reaches financial close and construction starts.

At an early stage of a project’s development, developers should have already developed a financial model to asses the project’s feasibility and a financial model needs to be sent to bankers when they come into the picture. Since I am an advocate of one model approach, I recommend that from the early development stage, you can build a model that can be then easily converted to lenders model but at the same time be used for the own developers assessment.

For more on One model approach check here:

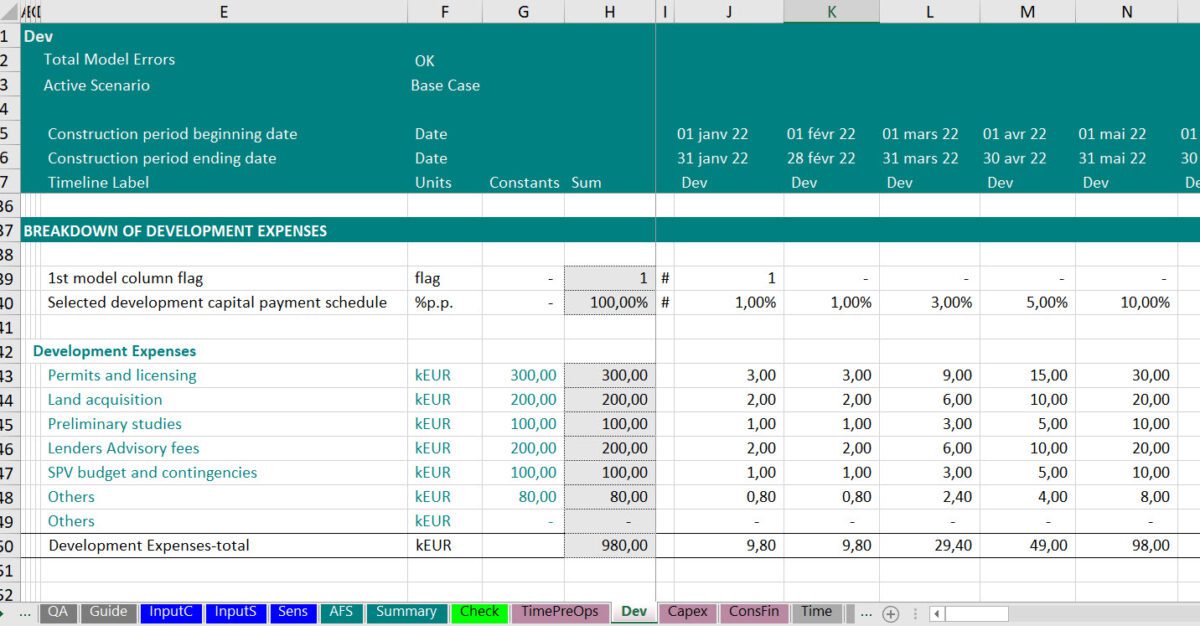

Development Costs or Development Outflows or Development Uses

The development phase in a project finance transaction may last from couple of months into years depending of the technology, scale or even where the project is situated. Throughout the development process and up to financial close date, developers will have to mobilise their own staff and incur traveling costs (internal development costs) and also buy licences and permits, hire external consultants and advisors to perform different studies (External development costs).

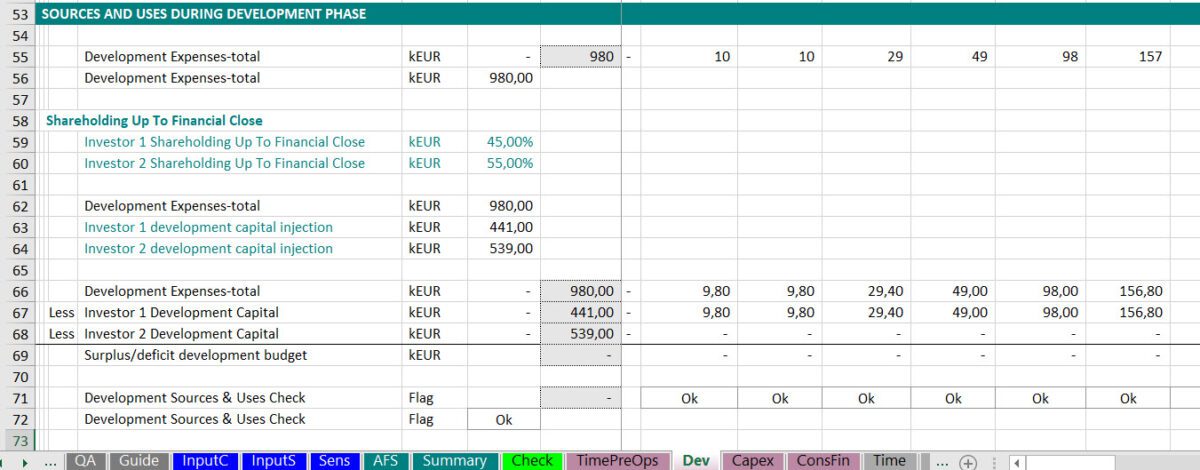

Development Sources or Development Inflows

Development capital: Funds contributed by the shareholders during development phase

Development Loan: Usually a short-term funding option

Grant: Funds from a government or organization to support the project (Available for projects with high development impact)

Download the Excel Template

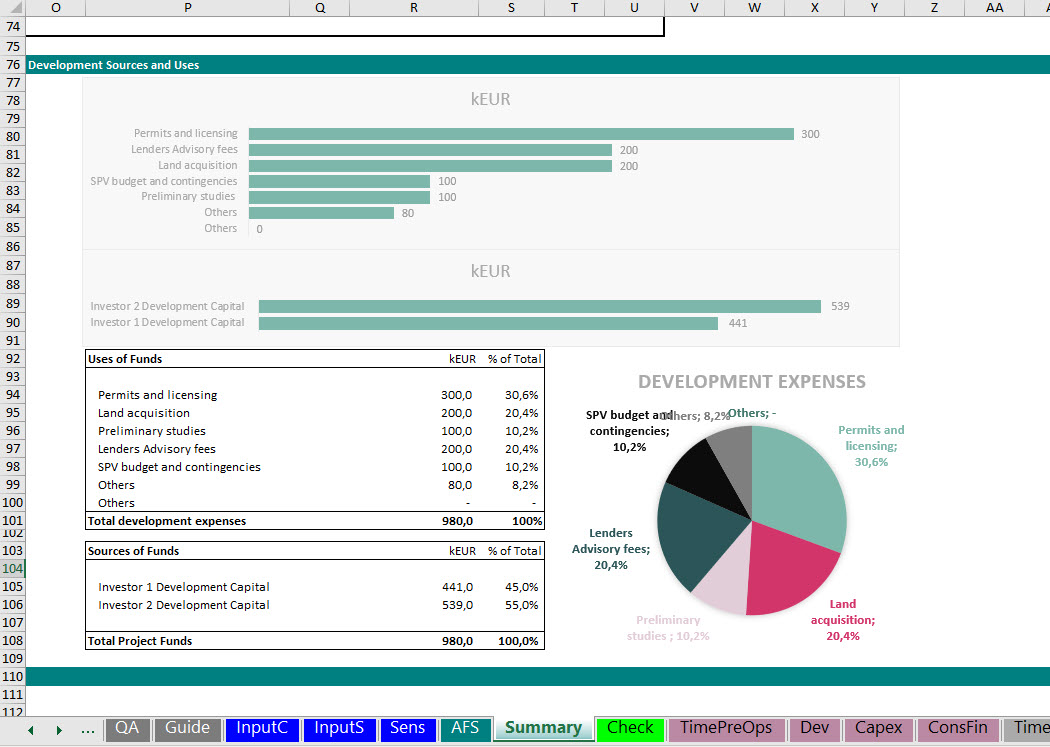

Development Sources and Uses

You put the sources and uses together and you get the sources and uses statement during development.

It should be reflected on periodic basis and a summary sources and uses can also be included in the “Summary” sheet or “Dashboard”

To make sure that all uses of funds on periodic basis are covered or in other words there’s no cash shortfall in the projection, a periodic check should be included.

Download the Excel Template

Things I didn’t cover here:

- What happens as you starts spending money and have actuals? You need to then revise the model to contain actuals. at this stage you don’t necessary need a separate sheet for actual development expenses and development capital injections. You can reflect them as time based hard-coded figures in your model and maybe just create a flag for showing the actuals versus projections.

- What if the capital injection timing is different than the billing like for example if you drawdown all the funds up-front and spend them gradually as you progress with development? In this case you definitively need to reflect the capital as injected and expenses as spend and to match the two you just need to create a reserve account (corkscrew account) to allow the unspent development capital to be carried forward and spent as per the uses.

- How about development capital remuneration? Development capital remuneration will come post financial close. This blog post is covering only pre-financial close cash inflows and outflows. However, I briefly talk about it in the video.