I started the discussion about equity return metrics in a project finance structure by looking at equity IRR. If you missed it, you can find a replay here or check out the related blog post .

Equity Return Metrics in a Project Finance Structure: Equity IRR

Today, I want to talk to you about project IRR.

What is Project IRR?

- Many times people use the term project IRR when they are reporting the equity IRR. So if you are in a discussion and the person is saying project IRR is this and that just stop the person and ask him or her what he means by project IRR.

- Project IRR is calculated from the cash flow of the project before financing. So if you hear or read that project IRR is 11%, this means that with 100% equity, the project is yielding 11% return.

- It is also called “unleveraged IRR” ; “unlevered IRR” or “Project unleveraged IRR”

How to use the Project IRR in a Project finance transaction?

The whole point of a project finance transaction is to raise debt off balance sheet of a corporation. Therefore a project IRR which assumes no debt financing has no or limited application in the context of a project finance deal. However, you might still want to calculate it for reporting purpose. Also during the early appraisal stage, when you still have flexibility to change the capital structure, you might want to consider a case where the project is funded with 100% equity during construction. This is relevant for projects with short construction phase like a PV solar project where it takes 6 to 12 months to build the whole installation, then it is wort it to look at the scenario with 100% equity financing during construction and then maybe refinancing post construction. I cover this topic in more detail in my discussion about the optimal capital structure.

The Choice of Optimal Capital Structure: Debt? Equity? Re-financing?

What’s the relationship between Project IRR, Equity IRR and cost of debt?

- We know that if project is funded with 100% equity then project IRR will be almost equal to equity IRR. I say almost because equity might also come at a cost like cost of insurance for equity for example, if investors require a political risk insurance.

- If the cost of debt is less than project IRR, then equity IRR will be greater than project IRR and as you increase the leverage equity IRR will tend to improve.

- If however, the cost of debt is greater than the project IRR, then the equity IRR will be less than project IRR and the conclusion will be that the current financing structure does not work. The project might requires a concessional loan at a low price and longer tenor, even envisage grant (if available) to make the project work with debt. If the cheap debt facilities are not available, then investor can consider equity financing during construction and raising debt once the project is de-risked post construction.

- to combine all the above points, one can say that the project IRR should be compared with the WACC (weighted average cost of capital).

Are there different forms of project IRR? and how to model it?

You can calculate the project IRR post tax and pre-tax.

Pre-Tax Project IRR:

- It is the project pre-tax pre-finance Internal Rate of Return (IRR)

- It is the project return based on the amount of cash left after non-financing construction and operating cost are paid.

- This is relatively easy to calculate. Typically you can find the information you need in the Cash flow cascade (or waterfall) statement. What you need are:

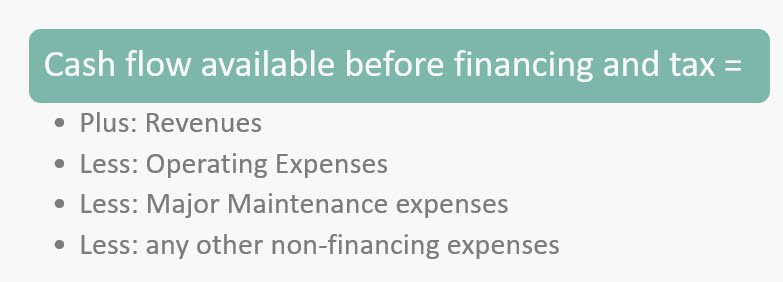

The cash flow available before financing and tax should be the basis for calculating the “Pre-tax project IRR”.

Post-Tax Project IRR:

- It is the project post-tax pre-finance Internal Rate of Return (IRR)

- It is the project return based on the amount of cash left after non-financing construction, operating cost and taxes are paid.

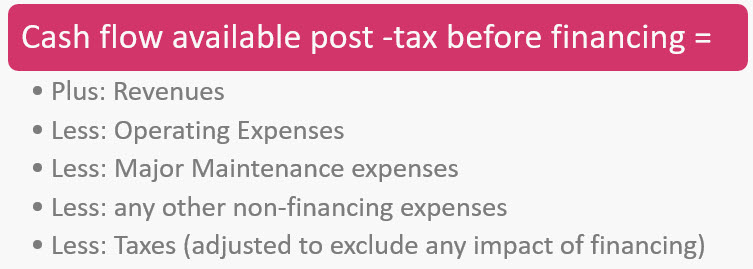

- the ingredients to calculate the post tax project IRR are:

- If you want be accurate, you can’t use taxes directly from your income statement or cash cascade. This is because there are some financing mixed with the amount of taxes that paid. For example, if interest is deductible then the amount of tax paid is influenced by the level of debt raised. So be accurate, you need to recalculate deprecation and remove any financing cost from the periodic depreciation and also exclude any financing costs that are deductible from the base for calculating the income tax used for the purpose of calculating the post tax project IRR.

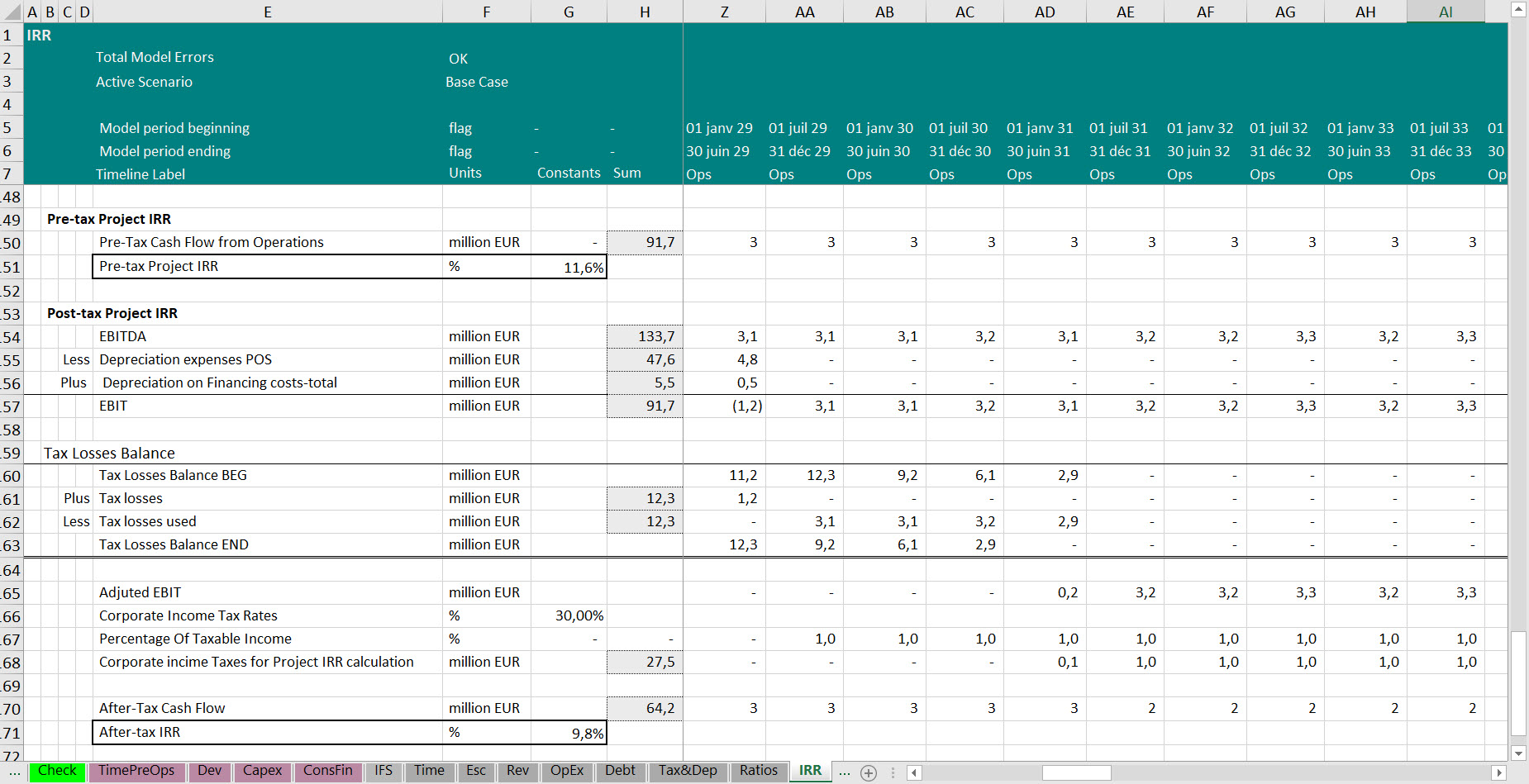

here’s an extract from one of my financial models. I walk you through that model in the below YouTube video and show you how I model project IRR in my project finance model.

Until next time, I wish you all the best.

Hedieh

Hedieh Kianyfard

The financial model detective

You can reach me at: h.kianyfard@finexmod.com