Both the human mind and financial models are interlinked systems. They are both tools that can be used for decision making.

Similar to how the mind can be programmed with thought patterns, a financial model can be programmed with formulas and Visual Basic codes to perform an analysis, to look at the past and to make future projections. Like the mind, based on the inputs that you provide to it, a financial model can be used to project a pessimistic or optimistic view of the future or of a present situation. It can be programmed to perform tasks automatically. However, it may also break down if there is a bug in the system. These are all features of our minds also.

Humans have been concerned with transforming their minds and financial modellers have been concerned with improving financial models. When talking about improving something means that there should be a problem or in case of human mind some sort of suffering that we are planning to get rid of. The similarity that I found in the problems of the mind and financial models are the vicious circle or in financial modelling term the circular reference problem.

Mind vicious cycle

The vicious cycle in the mind are all recurring negative thoughts that are the roots of our sufferings.

For example, if one is in a situation for example a breakup then the mind will automatically create negative thoughts of sadness, failure, worthlessness and these feelings will induce depressive behaviors isolation, inactivity and etc which in turns creates negative thoughts. That is a vicious circle.

Financial model vicious circle

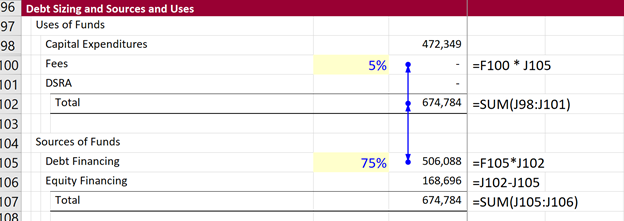

Circular references arise in an Excel financial model is when a cell refers to itself directly or indirectly.

In the example below, bank fees are calculated as 5% of debt and debt is sized as 75% of total uses of funds which contains fees and a circular reference results.

Resolving the circular reference

To deal with this issue, there are different options:

| Financial Model | Mind | |

| Avoidance |

Iterative model |

Depression |

| Surface remedy | copy and paste macro |

taking tranquillizers, finding refuge in something (new relationship, food, etc.) |

| Ultimate remedy |

User defined function |

Self-inquiry |

Avoidance

– Iterative model. This makes the model unstable and it is not recommended.

– For the mind, this is like avoiding the situation and not coping with the reality and living with depression.

Surface remedy

– copy and paste macro. This is a common method, but it significantly reduces the financial model functionality.

– In the mind context, this is like finding refuge in short term remedies like or taking tranquilizers to deal with distressing situations.

Ultimate remedy

– User defined function(UDF). This is a method developed by professor Edward Bodmer. It is the best method that solves for circularity and doesn’t negatively impact the model functionality. In this method you need to reprogram in VBA the equations causing circularity in the financial model, and then use this function in the Excel model. This method not only makes your model more flexible and faster; it also helps you to debug your models. This is because you are basically programming the same calculations twice: once in Excel and once in VBA. Most times the mistakes are in your Excel formulae rather than in the VBA code!

– Self-realization, freedom or enlightenment are said to be achieved through self-enquiry. This is a state in which your mind becomes quiet and you become the observer. You simply live and be in the moment. In words of Papaji “You are the unchangeable awareness in which all activity takes place.” So in other words, what it said to be enlightenment is a state in which you become the consciousness that contains your mind and your ego. The same way that Excel is the space that contains a financial model.

For more on the UDF method check www.edbodmer.com

For more on self-enquiry check for Papaji and Allen Watts on YouTube.